Guangzhou UnionPay reserve fund was exposed to unreasonable deduction and responded that it did not misappropriate funds.

Editor’s Note of China Economic Net: Recently, some media reported that a company that attracted investors in the name of managing money on behalf of its customers had a huge volume of 1 billion yuan in eight months, and then disappeared completely. The reporter’s investigation found that the above funds did not flow directly to the company, but passed through a reserve account named Guangzhou UnionPay Network Payment Co., Ltd. (referred to as "Guangzhou UnionPay"), and finally disappeared in the name of purchasing goods.

Investors said that they did not make online shopping, so the funds disappeared, which is obviously unexplained. Some lawyers pointed out that the third-party payment company should of course disclose to the payer who it will pay, as well as the amount and method. If the payment is made without receiving the instruction, it has obviously violated the property right of the payer.

However, Guangzhou UnionPay issued a clarification statement saying that the company has never intercepted, occupied or misappropriated any client’s funds, and has never been involved in any illegal and criminal activities. Regarding the disputes between the parties reflected in the relevant articles, it was found that the parties operated through the Internet and initiated payment through online banking with their own digital certificate (Ukey). Using digital certificate can accurately confirm their identity and transaction amount, which is undeniable, and the relevant transaction funds have been paid to the merchants in full.

Established in December 2001, Guangzhou UnionPay Network Payment Co., Ltd. is a high-tech enterprise owned by China UnionPay and wholly owned by UnionPay Commerce, specializing in bank card acquiring and specialized services, Internet payment, prepaid card acceptance and other main businesses. In May, 2011, it obtained the first batch of "Payment Business License" issued by the central bank.

It is reported that Guangzhou UnionPay has been repeatedly complained by users because of the problem of deduction from the reserve account. According to Guangyuan Evening News, 3,000 yuan in Ms. Guan’s bank card was inexplicably transferred to the account of Guangzhou UnionPay customer reserve, and then the fund was purchased. In addition, on the complaint website, enter "Guangzhou UnionPay" in the search column, and 52 search records appear. There have been complaints from users that "the account was deducted from the customer’s reserve fund of Guangzhou UnionPay Network Payment Co., Ltd. for no reason".

In response to this matter, the reporter from China Economic Net called Guangzhou UnionPay, and the customer service said that it would feed back the information to relevant colleagues and reply as soon as possible. As of press time, no reply has been received.

The whereabouts of users’ funds are a mystery. Guangzhou UnionPay: Never intercepted, occupied or misappropriated any customers’ funds.

"China Business News" reported that the account dispute of Guangzhou UnionPay made the whereabouts of users’ funds a mystery. It is reported that a company named Huibang Capital has been rolling up 1 billion yuan in eight months, and then disappeared completely. Zhao Hai, an investor, said that the company attracted investors in the name of managing money on behalf of customers (mainly speculating precious metals on behalf of customers). However, during the investigation, the reporter found that the above funds did not directly flow to Huibang Investment, but passed through the reserve account of Guangzhou UnionPay, and finally disappeared in the name of purchasing goods.

Zhao Hai and many other investors told this reporter that they bought Huibang Capital’s "Smart Win the World" precious metal trading wealth management investment products through a website in October 2015. The platform requires investors to open an account with at least 10,000 US dollars, use automated trading software, gain income through international foreign exchange spot gold trading, and see the changes of the corresponding account information of investors through MT4 (market quotation receiving software), so investors cannot operate.

It is worth noting that some investors inadvertently found something strange in the bank’s receipt. According to an electronic bank receipt provided by Zhao Hai, this is an online shopping receipt, the payee is "the name of the customer’s payer of Guangzhou UnionPay Online Payment Co., Ltd.", the trade name is "Zhonghui Business Online Payment", and the payment amount is about ××× 10,000 yuan.

Zhao Hai thinks that he didn’t do online shopping, and he didn’t get a product or service named "Zhonghui Business Online Payment", so the funds disappeared, which is obviously inexplicable. "Even if I invest in the wealth management products of Huibang Capital, it should show that our funds have been allocated to enterprises related to Huibang Capital, rather than flowing into other companies in the form of purchasing goods."

Zhang Feng, a lawyer of Shanghai Rongfu Law Firm, pointed out that Guangzhou UnionPay online payment has been suspected of breach of contract. "Third-party payment companies should of course disclose to the payer who they will pay, as well as the amount and method. If the payment is made without receiving the instruction, it has obviously violated the property right of the payer. There is an account agreement between the third-party payment company and the payer, so, more precisely, it is a breach of contract. "

For the risk of merchant credit review, industry analysts said that third-party payment platforms will not take the initiative to conduct risk review on interface enterprises, even including the authenticity of enterprises. As a third-party channel, the payment platform may recover funds based on moral pressure, but it will never bear legal risks.

On the morning of July 4th, Guangzhou UnionPay published a statement in official website, and hereby clarified this matter. The statement said, "Guangzhou UnionPay Network Payment Co., Ltd. has never intercepted, occupied or misappropriated any client’s funds, nor has it ever been involved in any illegal or criminal activities. Regarding the disputes between the parties reflected in the relevant articles, after the inquiry, the parties operated through the Internet and took the initiative to use their own digital certificate (Ukey) to initiate payment through online banking. Using digital certificates can accurately confirm their identity and transaction amount, which is undeniable and the relevant transaction funds have also been paid in full. "

The statement continued to point out that at present, the public security organs have investigated the disputes between the relevant parties and their trading partners, and the company will actively provide relevant clues and evidence to the public security organs.

3,000 yuan in the bank card was inexplicably transferred to Guangzhou UnionPay account and then the fund was purchased.

In March 2015, according to Guangyuan Evening News, Ms. Guan suddenly received a text message from the bank reminding her that 3,000 yuan in her card had been transferred to the account of Guangzhou UnionPay Network Payment Co., Ltd. Ms. Guan immediately went to the bank to make an inquiry and found that the money in the card was indeed taken away.

At 11: 33 am on March 18th, Ms. Guan, who was at work, suddenly received a reminder message from the bank, saying that she spent 0.38 yuan on one of her savings cards, and the message said it was a fund fee. Before she could react, the mobile phone received another text message, saying that the same item was deducted from its card for 3000 yuan. Because it is not time to deduct the mortgage, I have not made any payment or withdrawal. Ms. Guan immediately ran to the bank outlet to inquire and found that the money was indeed included in the account of the customer reserve fund of Guangzhou UnionPay Network Payment Co., Ltd.

Ms. Guan immediately called the customer service center of the company to which the other party’s account belongs, and learned that these two SMS deductions were actually not made by a company, but were transferred away by two fund companies in Beijing under Ping An Bank. Moreover, before her, the customer service center also received similar complaints, but because the merchants directly resolved with the complainant, they were not clear about the final settlement. However, the customer service center said that it would convey the complaint and let the other party reply as soon as possible.

In response to Ms. Guan’s situation, the staff of the personal customer department of the card-issuing bank said that they have been actively contacting the third-party platform to solve the problem. The public can first appeal by the "three-step" method with the assistance of the staff of the nearby outlets.

The first step is to print a bank card customer transaction inquiry form at a nearby outlet, and then call the bank’s manual customer service to explain the situation, inform the inquiry form of the transaction time, the other party’s account name, account number and other information, and send a short message after waiting for the manual customer service to inquire. Step 2: Call the customer service center number of the company to which the other party’s account belongs, which is provided by the SMS content, to make a complaint, indicating that there is no transaction before, and apply for compensation for the "deducted" funds, waiting for customer service inquiry. Step 3: Go to the police station to report the case, get the acceptance receipt, and prepare the relevant materials required by customer service.

The goodwill of Guangzhou UnionPay was damaged due to the deduction of the reserve account.

Established in December 2001, Guangzhou UnionPay Network Payment Co., Ltd. is a high-tech enterprise owned by China UnionPay and wholly owned by UnionPay Commerce, specializing in bank card acquiring and specialized services, Internet payment, prepaid card acceptance and other main businesses. In May, 2011, it obtained the first batch of "Payment Business License" issued by the central bank.

Customer reserve refers to the monetary funds actually received by the payment institution to handle the payment business entrusted by the customer. The payment institution shall handle the payment business entrusted by the customer after receiving the irrevocable payment instruction of the customer’s reserve fund or the customer’s transfer of the customer’s reserve fund, and shall not handle it in advance.

Guangzhou UnionPay is frequently criticized by netizens because of the problem of deduction from the reserve account. China Business News reported that in May this year, a user reported that the money in his bank account was actively transferred to Ping An Life Insurance Company of China Insurance through Guangzhou UnionPay, but the user did not buy any wealth management products of Ping An.

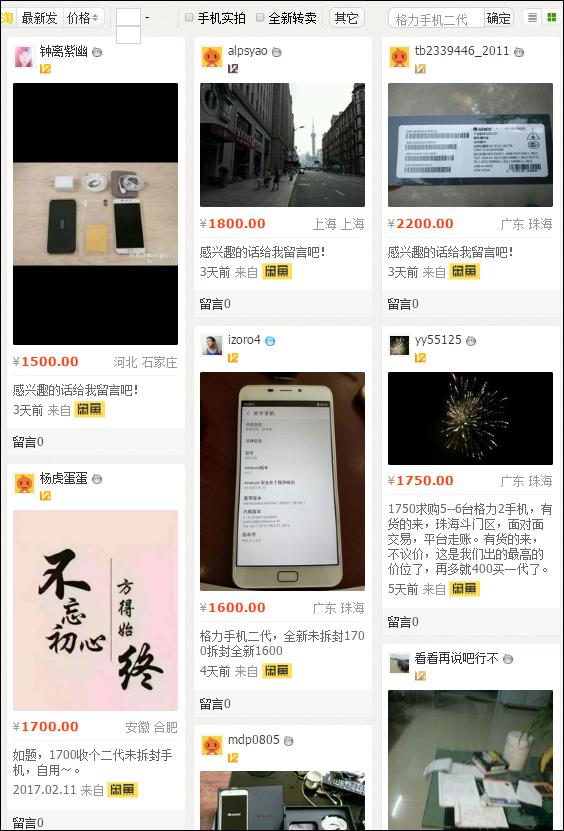

A reporter from China Economic Net logged on the website of Jucomplaint and entered "Guangzhou UnionPay" in the search column, and 52 search records appeared. There have been complaints from users that "the account was deducted from the customer’s reserve fund of Guangzhou UnionPay Network Payment Co., Ltd. for no reason". The complainant, Mr. Liu, reported that he found that the bank card was deducted 5448 yuan from the customer reserve fund of Guangzhou UnionPay Network Payment Co., Ltd. on March 31. Ms. Wu issued a complaint on March 13, saying, "I received a short message from the bank without knowing it, and the flow of the funds was ‘ Guangzhou unionpay network payment co., ltd. customer reserve fund ’ 。”

However, the reporter of China Economic Net has not received a reply from the relevant person of Guangzhou UnionPay, and the authenticity of the complaint information of Mr. Liu and Ms. Wu needs further confirmation.