Report on human rights violations in the United States in 2023 (full text)

The the State Council Press Office published the "Report on Human Rights Violations in the United States in 2023" on the 29th. The full text is as follows:

2023 Report on Human Rights Violations in the United States

People’s Republic of China (PRC)

the State Council Information Office

May 2024

catalogue

preface

First, civil and political rights have become empty talk

Second, the persistence of racism has far-reaching consequences

Third, economic and social inequality is increasing.

Fourth, the rights of women and children have been continuously violated.

5. The tragic situation of undocumented immigrants is shocking.

Six, American hegemony creates a humanitarian crisis.

tag

preface

In 2023, the human rights situation in the United States continued to deteriorate. In the United States, human rights are becoming increasingly polarized. Compared with a few people who occupy a dominant position in politics, economy and society, most ordinary people are increasingly marginalized and their basic rights and freedoms are ignored. 76% of Americans believe that their country is developing in the wrong direction.

American political parties are fighting, the government is disabled, governance is ineffective, and civil and political rights cannot be effectively guaranteed. It is difficult for the two parties to reach a consensus on gun control, and large-scale shooting incidents continue to be high. About 43,000 people died of gun violence, with an average of 117 people dying every day. The police abused violence in law enforcement. In 2023, at least 1,247 people died of police violence, a record high since 2013, but the accountability system for law enforcement was ineffective. The population of the United States is less than 5% of the world, but the number of prisoners accounts for 25% of the world. It is a veritable "prison country". The vicious struggle of political parties continued to intensify, and the election was manipulated by using constituency division. The House of Representatives twice staged a farce of "the speaker gave birth", and the government’s credibility continued to decline. The American people’s trust in the federal government was only 16%.

Racism in the United States is deeply rooted and the situation of racial discrimination is serious. United Nations experts pointed out that systematic racism against African-Americans has penetrated into the US police force and criminal justice system. Due to serious racial discrimination in medical services, the maternal mortality rate of African-American women is almost three times that of white women. Nearly 60% of Asians said that they faced racial discrimination, and the "China Action Plan" for Chinese scientists caused far-reaching harm. Racist ideology has spread viciously in American social media, music, games and other platforms, and has become a major exporter of extreme racism.

The polarization between the rich and the poor in the United States has intensified, the phenomenon of "worker poverty" has become prominent, and the economic and social rights protection system has been idling. The long-term disparity in labor distribution has led to the worst gap between the rich and the poor since the economic crisis in 1929. There are 11.5 million low-income working families in the United States, and the federal minimum hourly wage has not been raised since 2009. In 2023, the purchasing power of one dollar has dropped to 70% in 2009. It is difficult for low-income families to pay for basic necessities such as food, rent and energy, and there are more than 650,000 homeless people, a record high in 16 years. "Poverty of workers" shattered the "American dream" of Xin industrious authors, which led to the most widespread strike tide since the 21st century in 2023.

The rights of women and children in the United States have been systematically violated for a long time, and there are few constitutional provisions to guarantee gender equality. So far, the United States has not ratified the United Nations Convention on the Elimination of All Forms of Discrimination against Women, and it is the only country among the United Nations Member States that has not ratified the Convention on the Rights of the Child. In April 2023, the US Senate rejected the constitutional amendment proposal to guarantee gender equality. About 54,000 women in the United States lose their jobs every year because of pregnancy discrimination. More than 2.2 million women of childbearing age have no access to obstetric care. At least 21 states have banned or severely restricted abortion. The number of maternal deaths has more than doubled in the past 20 years. Sexual violence in the workplace, campus, family and other fields emerges one after another. Children’s rights to survival and development are worrying. A large number of children were excluded from Medicaid. Gun violence has become the main cause of child death. Drug abuse is spreading among teenagers. Forty-six states were found to have concealed about 34,800 cases of missing foster children.

The United States is a country that has benefited from immigration in history and reality, but there are serious problems of exclusion and discrimination against immigrants. From the infamous "Chinese Exclusion Act" in 1882 to the "Mu Ban Order" widely condemned by the international community in 2017, the practice of exclusion and discrimination against immigrants has been deeply embedded in the American institutional structure. Nowadays, the immigration issue has become a tool for the party to compete for profits and politics. Politicians ignore the individual rights and well-being of immigrants, and the immigration policy is simply copied as a partisan break position of "if you agree with me, I will oppose it", and finally it becomes a political show using voters. The immigration chaos has fallen into a vicious circle with no solution, and immigrants and children have been subjected to cruel treatment such as mass arrest, human trafficking and exploitation. Political polarization and the hypocritical nature of American human rights are vividly manifested in the immigration issue.

The United States has long pursued hegemonism, pursued power politics, abused force and imposed unilateral sanctions. Continued delivery of weapons such as cluster munitions to other countries has aggravated regional tensions and regional armed conflicts, resulting in a large number of civilian casualties and a serious humanitarian crisis. Wantonly carrying out "foreign agent" actions, undermining social stability in other countries and infringing on human rights in other countries. So far refused to close Guantanamo prison.

First, civil and political rights have become empty talk

Gun violence in the United States has caused a painful cost of life, and the struggle between political parties has made it difficult to reach a consensus on gun control. The government abuses its power to monitor citizens’ privacy, police violence is getting worse and worse, and the police law enforcement accountability system is ineffective. Political polarization continues to intensify, election manipulation is rampant, and the government’s credibility continues to decline.

Gun violence has caused a terrible loss of life. The data shows that all types of gun violence in the United States are on the rise. According to the statistics of the website "Gun Violence Archives", there were at least 654 mass shootings in the United States in 2023. Gun violence caused nearly 43,000 deaths, with an average of 117 deaths per day. For example, the ABC News website reported on October 28th, 2023 that a mass shooting incident occurred in Maine, killing at least 18 people and injuring 13 others. The USA Today website reported on December 6, 2023 that three university professors in Las Vegas were shot dead by a former colleague. Irene Malvi, president of the American Association of University Professors, called gun violence an "unacceptable national threat" and urged the US government to reform its gun policy. The surge in gun-related casualties in the United States has aroused serious concern of the United Nations Human Rights Committee.

The danger of gun violence overflows. The proliferation of guns in the United States has led to the intensification of gun smuggling in neighboring countries, which has brought great harm to the life safety of local people and regional stability. According to Mexican government data, more than 500,000 guns are smuggled into Mexico from the United States every year. Between 2014 and 2018, more than 70% of the guns collected at the scene of violent crimes in Mexico came from the United States. According to the investigation report of Crime Insight in Latin America in 2022, the illegal guns flowing into the Caribbean from the United States led to an increasing murder rate in the region.

Fighting among political parties makes it difficult to reach a consensus on gun control. The United Nations Human Rights Committee called on the United States to take all necessary measures to effectively protect the right to life and prevent and reduce gun violence. According to the survey report published on the website of Pew Research Center on June 28th, 2023, gun violence is widely regarded as a major and increasingly serious national problem, 58% of the respondents are in favor of stricter gun control laws, and more than 60% of American adults believe that gun violence is a major national problem in the United States today. However, American politicians ignore the calls of the international community and domestic people for gun control, and only care about money and political self-interest, so that the proliferation of guns in the United States has not been effectively controlled for a long time. In the article Gun Violence in America: Capitalism is the culprit, Al Jazeera columnist Belem Fernandez believes that "America is a country that puts profits above people". A series of shooting incidents, such as the Buffalo supermarket shooting, the Iuvaldi primary school shooting and the Highland Park parade shooting, which caused a large number of casualties, have defined American life. Smith-Wei Sen, an American gun manufacturing giant, earned at least $125 million in 2021 by selling assault rifles, which are often used in mass shootings. Joseph Blocher, an American constitutional scholar and a professor at Duke University Law School, believes that the political game has greatly damaged the efforts to formulate effective legislation to curb gun violence in the United States. Even if mass shootings occur frequently,It is also unlikely that the two parties will reach a new consensus on formulating specific measures for gun control. Driven by party polarization and interest groups, more and more state governments actively promote legislation to expand residents’ rights to own and carry guns. In 2023, at least 27 states in the United States can carry pistols without a license. Gun violence is persistent, and the government’s control policy is ineffective, which ultimately pays the price of ordinary people’s lives.

The government abused its power to monitor citizens’ privacy. The United Nations Human Rights Committee pointed out that the scope of Article 702 of the US Foreign Intelligence Surveillance Act is too broad, which not only allows US law enforcement officers to monitor the electronic communication of foreigners, but also may use legal loopholes to obtain a large number of communication information of American citizens without a search warrant (that is, "back door search"), and lacks a clear and transparent supervision mechanism. According to the report released by the Intelligence Committee of the US House of Representatives on November 16th, 2023, the US Federal Bureau of Investigation transferred the provisions of Article 702 of the Foreign Intelligence Surveillance Law to domestic surveillance, and monitored the communications of members of Congress, congressional campaign donors and anti-racist protesters "extensively and continuously". On November 20th, 2023, the website of Brennan Judicial Center reported that for more than ten years, new york Police Department abused social media to engage in illegal activities, including monitoring public meetings and tracking individual citizens and their contacts without evidence, but these behaviors were not supervised and held accountable.

Religious intolerance has worsened. Religious prejudice is a long-standing problem in American society. In recent years, the number of crimes caused by religious intolerance has continued to increase. According to the statistics of hate crimes released by the Federal Bureau of Investigation in October 2023, there were as many as 2,042 hate crimes based on religion in the United States in 2022. The American Committee on Islamic Relations released a report in April 2023, saying that in 2022, a total of 5,156 complaints involving discrimination against Muslims were received, mainly related to employment discrimination, education discrimination and unfair law enforcement, among which education-related complaints increased by 63% compared with 2021.

Freedom of speech and expression is suppressed. The harassment, intimidation, threats and attacks on media organizations and journalists by American government authorities, politicians and law enforcement officials have attracted the attention of the United Nations Human Rights Committee. Represented by Texas, Florida, Missouri, Utah and South Carolina, more and more states have passed laws to prohibit public schools from using educational materials and books on specific topics such as race, history and gender. Joe Coen, director of legislative policy at the Foundation for Individual Rights and Speech, is "deeply disturbed" by the surge in censorship. According to the foundation’s follow-up survey, the number of faculty members who have been punished or dismissed for their speech or expression has reached a new high in 20 years. The Associated Press reported on March 15th, 2023 that artist Katrina Majikut held an exhibition in a public school in Lewiston, Idaho, using embroidery works to show medical care issues such as chronic diseases and drugs. The exhibition was censored and removed on the grounds that it was suspected of being in conflict with the state’s "Public Fund Act against Abortion". Similarly, four documentary works by artist Lydia Nobles showing women’s experience of abortion were also deleted.

The number of people killed by police violence has reached a new high. The article "Ending the Culture of Police Violence" published on the website of Brennan Judicial Center on February 3, 2023 pointed out that the national security building in the United States is based on the culture and tradition of institutional violence. The abuse of force by American police is a prominent problem in law enforcement, but most law enforcement agencies refuse to publish data on the use of force. According to the data of the "Police Violence Map" website, the US police killed at least 1,247 people in 2023, the highest record since the organization began nationwide tracking in 2013. This means that at least three people are killed by the police every day on average.

The accountability system of police law enforcement exists in name only. Amy Laermann, a professor of public policy and political science at the University of California, Berkeley, and Weisla Weaver, a professor of political science at Hopkins University, co-authored the book "Arresting citizens: the democratic consequences of crime control in the United States", pointing out that the American police department has always rejected citizens’ doubts about the legality of its law enforcement actions, and the mechanism for investigating police violations is ineffective. In a paper published in the international medical journal The Lancet, University of Washington scholars Eve Wool and Mason Nahawi pointed out that more than half of the police killings in the official death statistics database of the US Centers for Disease Control and Prevention were wrongly marked as "ordinary murders or suicides". The New York Times website reported on January 31st, 2023 that the internal affairs department of American police is often more keen to exonerate colleagues than to investigate misconduct, which makes it difficult for police to be held accountable. The police union spared no effort to attack critics and excuse bad actors.

The problems of mass imprisonment and forced labor are prominent. The population of the United States is less than 5% of the world, but prisoners account for 25% of the prisoners in the world, which is the country with the highest imprisonment rate and the largest number of prisoners in the world. According to the report "Ten Statistics on Mass Imprisonment in the United States and Its Impact" released by the American public policy think tank "Prison Policy Initiative" in October 2023, about 2 million people are detained in federal and state prisons and immigration detention facilities in the United States every day, and about 3.7 million people are subject to community supervision such as probation and parole. According to a report released by the University of Chicago Law School and the American Civil Liberties Union in June 2023, American prison workers create billions of dollars worth of goods and services every year, and most States pay prisoners an hourly wage of only 2% to 3% of the federal minimum wage in the United States, and some States don’t even get any remuneration. The Prison Policy Initiative reported on March 14, 2023 that the work of prisoners in American prisons is compulsory, and imprisoned "workers" have almost no rights and protection. Prisons force prisoners to work with low pay or no pay and no benefits, and at the same time charge them for necessities, so that prisons can transfer the cost of imprisonment to prisoners.

Party struggles continue to intensify. The struggle between the two parties in the United States is fierce, and the two parties have also fallen into a stalemate of fragmentation and polarization. In January 2023, on the opening day of the 118th U.S. Congress, the House of Representatives suffered a crisis of "dystocia of the Speaker". After 15 rounds of seesaw voting, the House of Representatives elected a new speaker. In April, 2023, Tennessee Parliament expelled members Justin Jones and Justin Pearson on the grounds that they supported the local people’s demonstrations calling for strengthening gun control after a school shooting incident, which caused an uproar in politics. At the beginning of October, 2023, the Speaker of the House of Representatives suffered an unprecedented recall due to the failure to reach a consensus on major issues such as funding for the new fiscal year. Subsequently, the House of Representatives once again staged a more crazy farce of "the speaker’s dystocia" than nine months ago. Members of both parties competed for the position of Speaker for 22 days, regardless of the fact that the temporary appropriation for US federal expenditure was about to expire and the federal government was facing a crisis of closure. Because there is no speaker, the House of Representatives is in a state of suspension, thus interrupting the normal political agenda of the United States. On December 28th, 2023, The Economist published an article reviewing the chaos in American politics in 2023. The article commented that due to the busy infighting of political parties, the US Congress in 2023 did not pass much legislation, which is the least efficient Congress since the American Civil War.Perhaps the highlight of this year’s legislation is "Duck Ticket Modernization Act" (the main content of this bill is to amend a legal provision to make the hunting license of migratory birds electronic).

The two parties continue to rig the election. Money politics is prevalent in the United States, and the scale of burning money in elections is expanding. According to public data, in 2023, the Democratic and Republican candidates who participated in the election of the governor of Kentucky spent $91 million on campaign advertisements, which was more than three times that of the last election of the governor in 2019. It was the most expensive election in 2023. The two parties in the United States continue to change their tricks to manipulate constituency redrawing and distort the expression of ordinary public opinion for the party’s personal gain. An empirical study on the redistricting of electoral districts in the United States since 2021 by Princeton University’s "Jerry’s Wandering" project shows that there are 16 States in the United States that have obvious manipulations in the division of congressional electoral districts, and 12 of them are "states that have seriously manipulated electoral districts as a whole". In 2023, new york, Florida, Georgia, North Carolina and other states successively carried out high-profile redrawing of the House of Representatives with obvious party interests, which directly related to the party ownership of more than one-fifth of the seats in the House of Representatives. Among the 26 seats in the House of Representatives in New York State, the Democratic Party occupied 15 seats and the Republican Party occupied 11 seats after the election in 2022. However, according to the new map of redistricting districts led by the Democratic Party in 2023, the Democratic Party can maintain 15 seats while forming strong enough competition in at least 6 constituencies controlled by the Republican Party. North Carolina’s 14 House seats are currently roughly evenly divided between the two parties.However, according to the arrangement of the Republican Party after redistricting in 2023, the Republican Party can maintain control of at least 10 constituencies, that is, 10 seats.

The credibility of the government continues to decline. The general public in the United States are extremely disappointed with the Federation and governments at all levels, and most think that the United States is in the wrong direction. According to the survey data of Pew Research Center, American people’s trust in the federal government has been at a historical low for a long time, only 16% in 2023. According to the monthly survey conducted by Gallup polling agency, from January to December, 2023, 76% to 81% of Americans expressed dissatisfaction with the development trend of the country. In addition, 76% of Americans think that their country is in the wrong direction of development, and only 23% think that the United States is in the right direction of development. Young Americans are generally dissatisfied with the practice of democratic politics. According to a survey conducted by the Institute of Political Economy of American University in 2023, 48% of the respondents aged 18 to 34 believed that the American political system hindered them from realizing the American dream more. Young Americans are alienated from party politics and have a low willingness to vote. According to a study released by Tufts University, in the mid-term election of the US Congress in 2022, the turnout rate of young voters nationwide was only 23%.

Second, the persistence of racism has far-reaching consequences

The United Nations Human Rights Committee pointed out that racism in the United States still exists in the form of racial stereotypes, police killings and many human rights violations. Ethnic minorities in the United States face systematic, persistent and comprehensive racial discrimination, and racist ideology is widely popular in American society and spreads viciously to the international community.

People of African descent face serious racial discrimination in the field of law enforcement. On January 3rd, 2023, Kenan Anderson, a 31-year-old African-American man in Los Angeles, was suspected of causing a traffic accident. During the process of subduing him, the police hit him six times with a stun gun, causing him to have a heart attack and died in hospital. On January 7, 2023, the police in Memphis, Tennessee stopped Tyr Nichols, a 29-year-old African-American man, for "reckless driving" and brutally beat him for several minutes. Three days later, Nichols died of his injuries, and the investigation afterwards could not confirm the police’s statement that he was "reckless driving". These two cases of African-Americans killed by police violence in law enforcement have attracted the attention of many UN experts. Experts stressed that in the two incidents, the use of force by the police violated the international norms to protect the right to life and prohibit torture and other cruel, inhuman or degrading treatment or punishment, and was also inconsistent with the United Nations Code of Conduct for Law Enforcement Officials and the Basic Principles on the Use of Force and Firearms by Law Enforcement Officials. After a field visit to the United States, the international independent expert mechanism of the United Nations Human Rights Council to promote racial justice and equality in law enforcement pointed out that systematic racism against African-Americans has penetrated into the American police force and criminal justice system. African-Americans are three times more likely to be killed by police and 4.5 times more likely to be imprisoned than whites. In more than 1,000 police killings each year,Only 1% of the police involved were charged. The report warns that many killings will continue if the United States does not reform the rules on the use of force by the police in accordance with international standards.

Hate crimes against African-Americans are frequent. The Associated Press reported on August 29, 2023 that a masked white man shot and killed three African-Americans in Jacksonville, Florida, and the gunman committed suicide after making racist remarks. The USA Today website reported on August 29, 2023 that African-Americans became more and more uneasy after many shootings against them. Benny Thompson, former chairman of the House Homeland Security Committee, pointed out that racial attacks, including the Jacksonville shooting, highlighted the growing trend of violence against African-American communities. According to the statistics of hate crimes released by the Federal Bureau of Investigation in October 2023, there were 3,424 hate crimes against African-Americans in the United States in 2022. According to the report released by the Attorney General’s Office of California on June 27th, 2023, the number of hate crimes against African-Americans in the state increased from 513 in 2021 to 652 in 2022, an increase of 27.1%.

African-Americans face serious racial inequality in the medical field. According to the report released by the United Nations Population Fund in July 2023, the maternal mortality rate of African Americans is higher than that of all other ethnic groups and groups because of systematic racism in the health care system. According to the data of the US Centers for Disease Control and Prevention, 69.9 African-American pregnant women die every 100,000 during pregnancy or childbirth, almost three times that of white women, and this difference is common among African-American women with different education and income levels. The mortality rate of African-American babies in the United States is also the highest among all ethnic groups, with nearly 11 deaths per 1,000 live births, which is about twice the average mortality rate.

对非洲裔种族迫害的赔偿遥遥无期。美国南北战争结束不久后,美国政府承诺向曾被奴役的每一个非洲裔家庭进行赔偿,但一百多年来这一承诺从未兑现。1989年,美国众议院非洲裔议员约翰·科尼尔斯提出“研究和制定非洲裔美国人赔偿提案委员会法案”(H.R.40法案),但这一法案数十年来从未进入过国会表决程序。1921年,美国俄克拉何马州塔尔萨地区发生针对非洲裔的种族屠杀事件,导致数百人遇害。为塔尔萨大屠杀最后3位已知幸存者争取赔偿的诉讼仍未定案,而其中年龄最低的幸存者休斯·范·埃利斯已于2023年10月去世。皮尤研究中心2023年8月10日发表的报告显示,83%的非洲裔美国人表示,美国政府所做的确保平等的努力还远远不够。许多不满美国政治和种族歧视的非洲裔选择离开。离开美国的非洲裔在葡萄牙、加纳、哥伦比亚和墨西哥等地建立了新的社区,这已然成为一种名为“Blaxit”的潮流(“Black”和“exit”的结合),并在社交媒体上广泛流传。他们高呼:“美国配不上我!”

Discrimination against Asians has intensified. According to a survey released by the Pew Research Center on November 30, 2023, nearly 60% of Asian Americans said that they faced discrimination because of race or ethnicity. A survey conducted by the Associated Press found that 51% of Asians and Pacific islanders believe that racism is an "extreme" or "very serious" problem in the United States. A survey report jointly released by the School of Social Work of Columbia University and the NGO committee of 100 on April 27th, 2023 shows that nearly three quarters of Chinese Americans have suffered racial discrimination in the past year, and 55% of Chinese Americans are worried that hate crimes or harassment will endanger their personal safety.

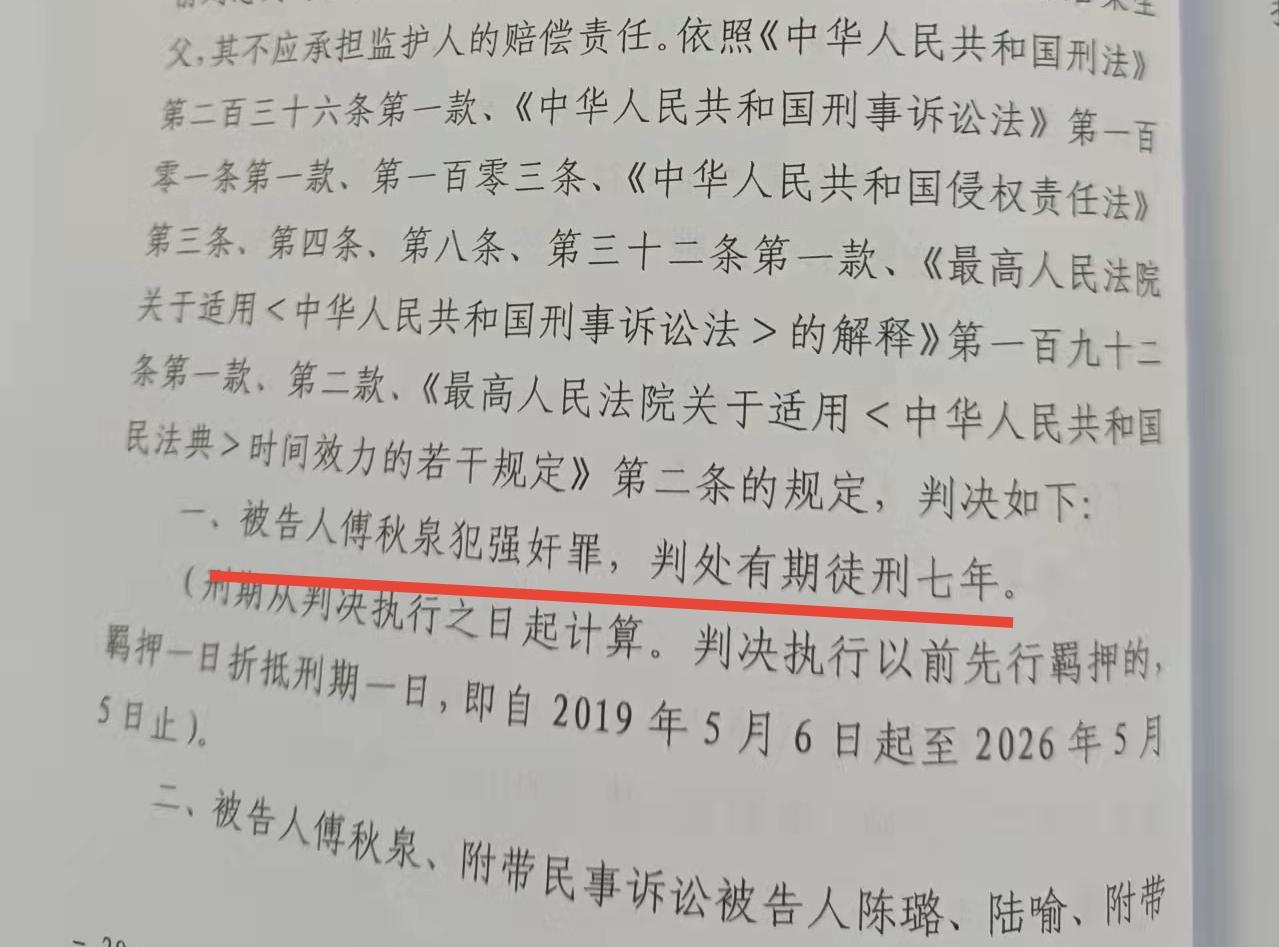

The persecution of Chinese scientists continues. Although the American government’s "China Action Plan" for Chinese-American scientists has been suspended, its far-reaching influence still exists, and many Chinese-American scientists still have a strong sense of insecurity. On March 23rd, 2023, Science magazine published an article about the persecution of Chinese scientists by China Action Plan. Of the 246 people surveyed by the National Institutes of Health, 103 lost their jobs, and more than one-fifth of them were banned from applying for NIH funding within four years, which dealt a great blow to their academic careers. Among these 246 people, 81% scientists are Asian. A survey by Princeton University, Harvard University and Massachusetts Institute of Technology on nearly 1,400 Chinese-Americans who hold tenured positions in American universities shows that 72% of them feel insecure and 42% are afraid to conduct research in the United States.

China students studying in the United States experience nightmare treatment at the US Customs. In recent years, the U.S. government has constantly generalized the so-called "national security" concept, politicized and weaponized academic research, and fabricated various excuses to block international exchanges and cooperation in humanities and science and technology. On January 11th, 2024, China Science reported that many China students were subjected to unreasonable difficulties and inhuman treatment at the US Customs, and they were caught in the dilemma of not finishing their studies as scheduled. Meng Fei (pseudonym), a student studying in China, was detained by the US Customs twice for 20 hours at Washington Dulles International Airport on December 19, 2023, and was detained for 5 hours while waiting for a connecting flight in Los Angeles, and then repatriated. During this period, she was not only forced to sign "accept repatriation" under the guidance of the censor and under the watchful eye of two policemen armed with guns and electric batons, but also was searched in a humiliating way and kept in solitary confinement for 12 hours. Cindy Wei (pseudonym), a China student from Hopkins University, was also told to be repatriated by the US customs inspector at Dulles International Airport on November 24, 2023, on the grounds that his visa was cancelled by the US Embassy in China two days before his entry. However, Cindy Wei contacted the US Embassy in China many times after returning to China, but was told that his visa was not revoked by the Embassy, but decided by the US Customs. Many foreign students from China who had the same experience said that their transcripts at the US Customs had been intentionally or unintentionally tampered with. They sought help from all walks of life to complete their studies, and even if their American school contacted the customs, they did not get any effective reply.Some people have to choose to drop out of school.

Infringement on the rights of Indian aborigines has not disappeared. The Associated Press reported on November 6, 2023 that for more than 150 years, Indian aboriginal children were taken away from their communities and forced to enter boarding schools, which abused students to assimilate them into white society. The trauma caused by these schools has spread to generations, contributing to problems such as alcoholism, drug addiction and sexual abuse. CNN reported on November 22, 2023 that for hundreds of years, Indian aborigines have been living under cultural oppression, and their religious beliefs and traditional customs have been ruthlessly strangled. In August 2023, an 8-year-old Indian boy was forced by the school to cut off his long hair. However, according to the cultural tradition of the Wyandotte nationality to which the boy belongs, they only cut off their long hair when their loved ones die. According to the report released by the National Institute of Environmental Health Sciences on November 20th, 2023, compared with Americans of other ethnic groups, the health status of Indians and Alaska aborigines is poor for a long time, and the low life expectancy and heavy medical burden of aborigines are common problems. Trula Ann Bruninger, CEO of Native American Connection, said that there is a serious shortage of medical insurance funds for Indian aborigines. Although the US federal government has provided medical insurance for aborigines, there is a gap between funds and actual needs. The Indian Health Service under the U.S. Department of Health and Human Services provides federally funded medical care for nearly 2.6 million Indian aborigines.But this figure is less than 50% of the national Indian and Alaska Native population. Compared with other ethnic groups, American Indians and Alaska Native Americans have the highest proportion of lack of medical security.

Ethnic minorities encounter workplace discrimination. The "Report on Interview Experience of Job-seekers in 2023" released by a recruitment software company named "Greenhouse" in the United States shows that the discrimination in the recruitment process is "quite worrying". 34% of job seekers have encountered discriminatory problems in the interview, and nearly one-fifth of job seekers have tried to change their names in their resumes to avoid being affected by discriminatory recruitment behavior. Among the job seekers who changed their names, 45% wanted to sound "less ethnic". On April 23, 2023, the website of the British Guardian revealed that the US government has deliberately evaded the responsibility of labor protection and squeezed minority workers for decades. New york’s colored ethnic care workers are not only forced to work for long hours, but also their salaries are deducted. Many nursing workers suffer from insomnia, chronic diseases and other diseases, causing serious harm to nursing workers and their families. Ethnic minority workers have been trying to fight for rights protection through various channels, but they have achieved little success under the obstruction of some interest groups. Vauxnews reported on June 12, 2023 that in the United States, African-Americans have always earned less than whites. This difference means that under the influence of racial discrimination, the time value of African-Americans is obviously lower than that of whites. In order to make up for the wage gap caused by discrimination, African-American workers must work 2.7 hours more every day.

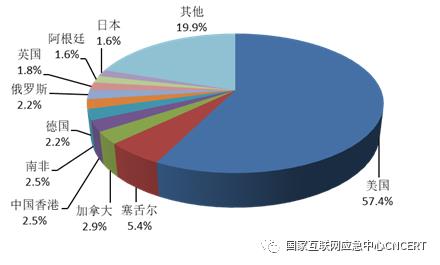

Racist ideology spreads viciously in the United States and overflows across borders. With the worsening of racism in the United States, the spread of racist ideology and speech has also shown a new trend. Racists have opened up a new communication space on the Internet, and used social media, music, games and other platforms to extensively infringe and harass ethnic minorities. In May 2022, Peyton Maurice Gendron, a white gunman who killed 10 African-Americans in a supermarket in Buffalo, new york, posted a message on the game chat application community that a game on a certain game platform had a great influence on his radical behavior. In July 2023, a 14-year-old white boy from Massachusetts tried to drown an African-American boy "for racial motives". At the time of the incident, other white boys present joked that the victim was "George Freud". Racism in the United States has shown a trend of transnational proliferation and has become a major exporter of extreme racism, which has aroused the vigilance of many countries. Bruce Hoffman and Jacob Weil, researchers of the American Council on Foreign Relations, published the article "American Hatred Spread to the World" on the website of Foreign Affairs magazine on September 19, 2023, saying that the United States has become a typical country exporting extreme right-wing extremism and terrorism. Conspiracy theories, racial superiority, anti-government extremism and other forms of hatred and intolerance have spread so seriously in the United States.So that some countries have labeled some American groups and citizens as foreign terrorists.

Third, economic and social inequality is increasing.

The United States not only lacks constitutional provisions on the right to work, education and health, but also refuses to ratify the International Covenant on Economic, Social and Cultural Rights. The poor are classified as "poverty trap" because of their laziness, and their economic, social and cultural rights are stigmatized as "welfare cheese". The phenomenon of "worker poverty" is widespread, and the polarization between the rich and the poor has further expanded.

The gap between the rich and the poor has widened further. The gap between the rich and the poor in the United States has reached the most serious level since the 1929 economic crisis. According to the data released by the global statistical database on November 3, 2023, the poverty rate in the United States in 2022 was as high as 11.5%. According to the Federal Reserve survey, as of June 2023, the excess savings of the bottom 80% households in the United States have been exhausted, but among the richest 20% households, the cash savings are still about 8% higher than when the COVID-19 epidemic broke out. In the third quarter of 2023, 66.6% of the total wealth in the United States was owned by the top 10% of the income. In contrast, the lowest income 50% people only own 2.6% of the total wealth. Matthew Desmond, an American economist, hit the nail on the head and pointed out that in 2023, most Americans were working hard. However, the rich were getting richer and richer, and those struggling at the bottom of society were trapped in deep-rooted poverty. Opportunities in American society are hoarded and social mobility is reduced, which is rooted in three institutional designs: exploiting the poor, subsidizing the rich and separating classes.

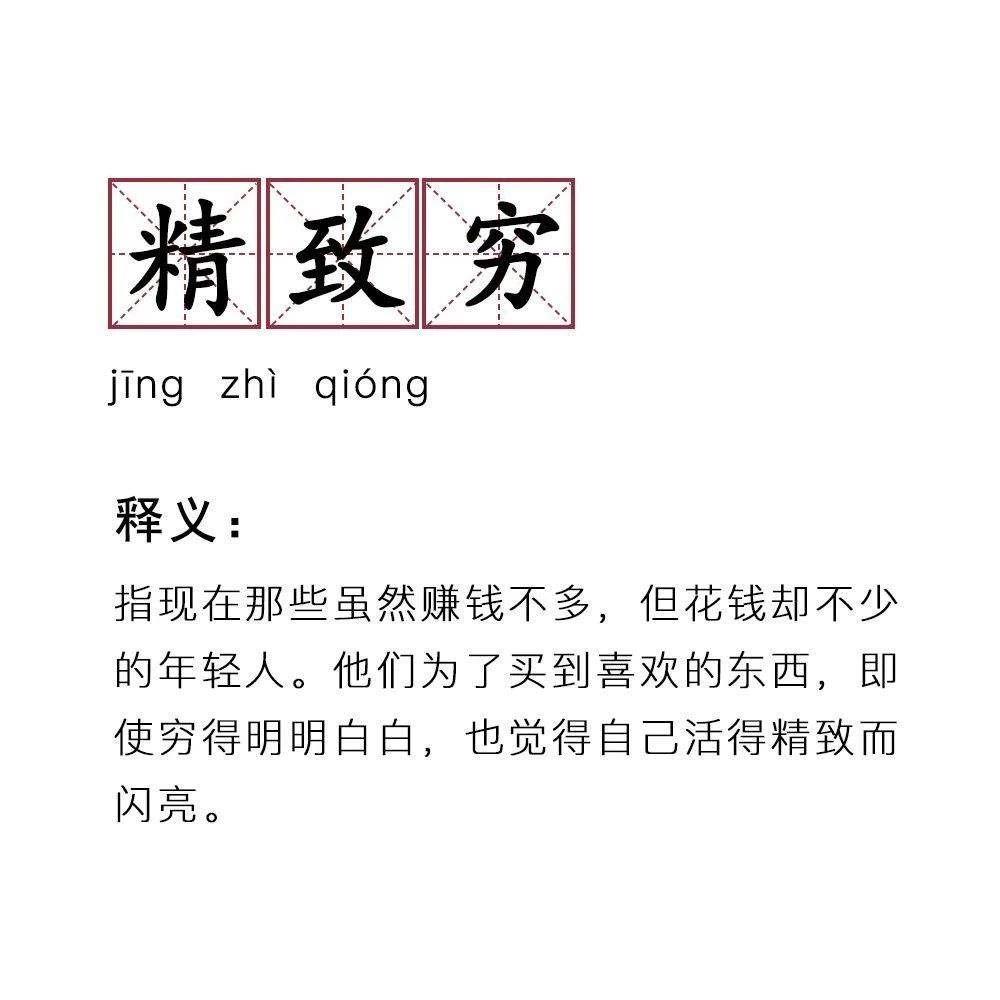

The problem of "worker poverty" is prominent. Structural changes have taken place in the labor market in the United States, and low-paying jobs and lack of supervision are widespread. There are a large number of "working poor" who work all day long, but their wages are difficult to maintain their basic livelihood and lack due social security. The minimum hourly wage in the United States has not been raised since 2009. According to data from the US Department of Labor, there are still 20 states maintaining the federal minimum hourly wage in 2023. There are 11.5 million low-income working families in the United States, and more than 29.9 million Americans, including 14.8 million children, live in these low-income working families. The disparity in income growth between labor and capital has led to a large-scale strike in many industries. In 2023, the most widespread strike wave occurred in the United States since the 21st century, with large-scale strikes in many industries including film and television, manufacturing, medical care and media. Benjamin Newman, an associate professor at the School of Public Policy and Politics of the University of California, commented that the "working poor" trapped in structural poverty lack equal opportunities and are hard to move upward, which greatly reduces their belief in the "American Dream".

It is difficult for low-income families to meet their basic needs. The price level in the United States remained high in 2023, and with the burden brought by the continuous interest rate hike, the living expenses of Americans continued to rise for several years. According to the consumer price index of the Bureau of Labor Statistics, the purchasing power of one dollar in 2023 is only 70% of that in 2009. Low-income families can hardly meet the basic needs of life such as food, rent and energy, and even run out of savings and are heavily in debt. According to a joint survey conducted by the Financial Times and the Ross School of Business of the University of Michigan in 2023, 74% of American respondents said that rising food prices had the greatest impact on their financial situation. According to the Household Debt and Credit Report released by the Federal Reserve on November 7, 2023, the household debt in the United States reached a historic $17.29 trillion in the third quarter of 2023. Credit card default rate and serious default rate (overdue for more than 90 days) reached the highest level since the end of 2011.

The number of homeless people has reached a 16-year high. According to a report released by the U.S. Department of Housing and Urban Development on December 15th, 2023, there are more than 650,000 homeless people in the United States at this stage, a record high since statistics were available in 2007. Among them, 40% homeless people can only live in streets, abandoned buildings or other harsh environments that lack shelter. Homeless people not only struggle to survive, but also face higher and higher risk of criminal conviction. A study by the National Homeless Law Center found that more and more cities in the United States are actively legislating to punish the homeless. From 2006 to 2019, the laws prohibiting camping in public places in the United States increased by 92%, the laws prohibiting sleeping in public places increased by 50%, the laws prohibiting sitting and lying in public places increased by 78%, the laws prohibiting wandering in public places increased by 103%, and the laws prohibiting living in vehicles increased by 213%. According to these laws, it is illegal for homeless people to sleep, camp, eat, sit and beg in public places. The authorities have the right to expel them from public places, confiscate their property and isolate them in collective shelters or prisons that are usually unhygienic and inhuman. This violation of the basic human rights of the homeless in the United States has been widely criticized. The United Nations Human Rights Committee urges the United States to abolish laws and policies at all levels that criminalize homelessness and take legislative and other measures to protect the human rights of the homeless.

A large number of families face food shortage. The disparity between the rich and the poor, the poverty of workers and the lack of social safety net have led to the resurgence of hunger and food insecurity in the United States. According to a report released by the US Department of Agriculture, nearly 13% of American families are in the predicament of food shortage in 2022, which is much higher than that in 2021. This means that 44.2 million Americans live in families with three meals, including 13 million children.

Drugs and drug abuse continue to spread. Interest groups use party struggle and money politics to trade money and power, and promote the legalization of marijuana into a spreading trend. As of November 2023, 24 states in the United States have legalized recreational marijuana. According to the research of Mingchang Group, an American cannabis market research organization, the annual sales of the American cannabis market is estimated to exceed $31.8 billion in 2023 and will increase to $50.7 billion in 2028. According to a report released by the National Institutes of Health in August 2023, the number of adults aged 35 to 50 in the United States who smoked marijuana and used hallucinogens in 2022 was 28% and 4%, respectively, reaching the highest level in history; Among the young people aged 19 to 30, 44% have smoked marijuana within one year, 11% have smoked marijuana every day, and 8% have used hallucinogens. According to a survey conducted by the US Bureau of Substance Abuse and Mental Health Services, in 2022, 70.3 million Americans over the age of 12 abused drugs, of which 61.9 million smoked marijuana. According to a survey released by the University of Michigan in December 2023, in 2023, 10.9% of eighth-grade students, 19.8% of tenth-grade students and 31.2% of twelfth-grade students in the United States abused drugs.

The suicide rate continues to climb. The USA Today website reported on November 29th, 2023 that the suicide rate of Americans has been rising continuously in recent ten years. In 2022, there were 14.3 suicides per 100,000 people, reaching the highest point since 1941. According to the report released by the US Centers for Disease Control and Prevention in 2023, it is estimated that 49,449 people died of suicide in 2022, an increase of 2.6% over 2021. From 2018 to 2021, the suicide rate of people of African descent aged 10 to 24 increased by 36.6%, the largest increase among all age groups.

Fourth, the rights of women and children have been continuously violated.

So far, there is no prohibition of gender discrimination in the US Constitution. Gender discrimination in the workplace is serious, and the income gap between men and women is widening. The protection of women’s right to life and health is insufficient. The maternal mortality rate continues to be the highest in developed countries, and the prohibition of abortion seriously damages women’s reproductive rights and health rights. Sexual violence in the workplace, campus and other fields emerges one after another. Children’s rights to survival and development are worrying. The number of poor children has soared, a large number of children’s medical insurance has been cancelled, and children’s right to health has been seriously threatened.

The constitutional provisions prohibiting gender discrimination have long been absent. Driven by the surging civil rights movement in the 1950s and 1960s, the legislative action to amend the American Constitution to guarantee equality between men and women was put on the agenda in 1972, but it has not been realized after more than 50 years. In April 2023, the US Senate rejected a proposal to amend the Constitution to achieve gender equality. The Human Rights Committee of the United Nations regrets that the Constitution of the United States still lacks a safeguard clause prohibiting gender discrimination.

Maternal mortality is the highest in industrialized countries. The maternal mortality rate in the United States is the highest among industrialized countries, and far exceeds other industrialized countries. A study published in the Journal of the American Medical Association in July 2023 shows that the number of maternal deaths in the United States has more than doubled in the past 20 years. More than 2.2 million American women of childbearing age have no access to obstetric care, and another 4.8 million women of childbearing age live in areas with insufficient obstetric care resources. In Alabama, about 39% of counties have no obstetric service provider, and more than 240,000 women live in counties with little or no obstetric care guarantee.

The prohibition of abortion has dealt a devastating blow to women’s reproductive rights and health rights. In 2022, the Supreme Court of the United States made a judgment to overturn the protection of women’s right to abortion, which caused a devastating blow to the legal protection of millions of women’s right to health and reproductive health care. As of December 2023, at least 21 states in the United States have banned or severely restricted abortion. In these 21 States, medical services for abortion are basically unavailable. United Nations experts pointed out that the judgment of the United States Supreme Court deprived women and girls of their basic human rights to comprehensive medical care, including sexual and reproductive health, which violated international human rights law. The laws of some states consider it a crime to provide or seek abortion care. These laws restrict women from seeking abortion care in other states and prohibit medical abortion.

Violence against women exists in many fields. The United Nations Human Rights Committee pointed out that violence against women, including domestic violence and sexual violence, persists in the United States. Sexual violence against women and girls is widespread in American schools, higher education institutions and the armed forces. A survey of California State University, the largest public university in the United States, shows that sexual violence is generally condoned in its 23 campuses. Most of the administrative staff of the school did not investigate the allegations of sexual assault received; In a few cases investigated, no action is taken even if the defendant is found to be at fault. From 2018 to 2022, at least 1,251 employees of the school were accused of sexual harassment, and only 254 cases were investigated. Scandals of sexual assault continue to break out in volleyball, football, softball, baseball and other sports of Northwest University, and whistleblowers claim that sexual abuse and racial discrimination are rampant in these sports. According to data released by the Federal Bureau of Investigation, more than 600 American women are shot by intimate partners every year, and one person is shot every 14 hours.

Gender discrimination in the workplace is serious. The wage gap between men and women continues to widen. The British "Times" website reported on August 8, 2023 that the wage gap between men and women in the United States has expanded from 20.3% in 2019 to 22.2% in 2022. Pregnancy discrimination is widespread. The website of The Independent reported on May 11th, 2023 that according to the data of the Equality and Human Rights Commission, about 54,000 women in the United States lose their jobs every year because of pregnancy discrimination.

There has been a sharp increase in child poverty. According to the report released by the US Census Bureau in September 2023, in 2022, the number of poor people in the United States surged, and more than 5 million children fell into poverty, and the child poverty rate more than doubled. This is the largest annual increase in the number of poor children since records began. One of the important reasons is that the United States government canceled the child tax credit program, which made children fall into poverty again.

A large number of children’s medical insurance was cancelled. From April to October 2023, more than 10 million adults and children were excluded from the medical insurance subsidy program by the US federal government. Camille Richu, director of health policy of Arkansas Children and Family Advocates, said: "The US government’s re-evaluation of the eligibility of medical insurance subsidies is not to determine who is eligible, but to try every means to kick people out of this plan." The health status of children has been significantly affected by this change. At least 1.8 million children have been deprived of medical insurance subsidies in 20 states with age data.

Thousands of foster children go missing every year. An audit published by the US Department of Health and Human Services in 2023 found that 46 states reported about 34,800 cases of missing foster children. According to data from the National Center for Missing and Exploited Children, between 2018 and 2022, nearly 1,800 children in Georgia were missing, and more than 20% of them may be trafficked.

Children in the juvenile justice system are subjected to inhuman treatment. In October, 2023, the investigation by the international independent expert mechanism of the United Nations Human Rights Council to promote racial justice and equality in law enforcement showed that the American criminal justice system was full of some unique inhuman practices. The United States is the only country in the world that sentences children to life imprisonment without parole. In Georgia, the head of child welfare agencies asked judges to detain children with mental and behavioral problems in juvenile prisons. Since October 2022, as many as 80 children have been taken to the Angolan prison in Louisiana, which is famous for its violence, and held in the cells of death row inmates awaiting execution. Although these children are separated from adult prisoners, they suffer from dangerous heat waves, are kept in prison for a long time, use sewage, and can’t get education.

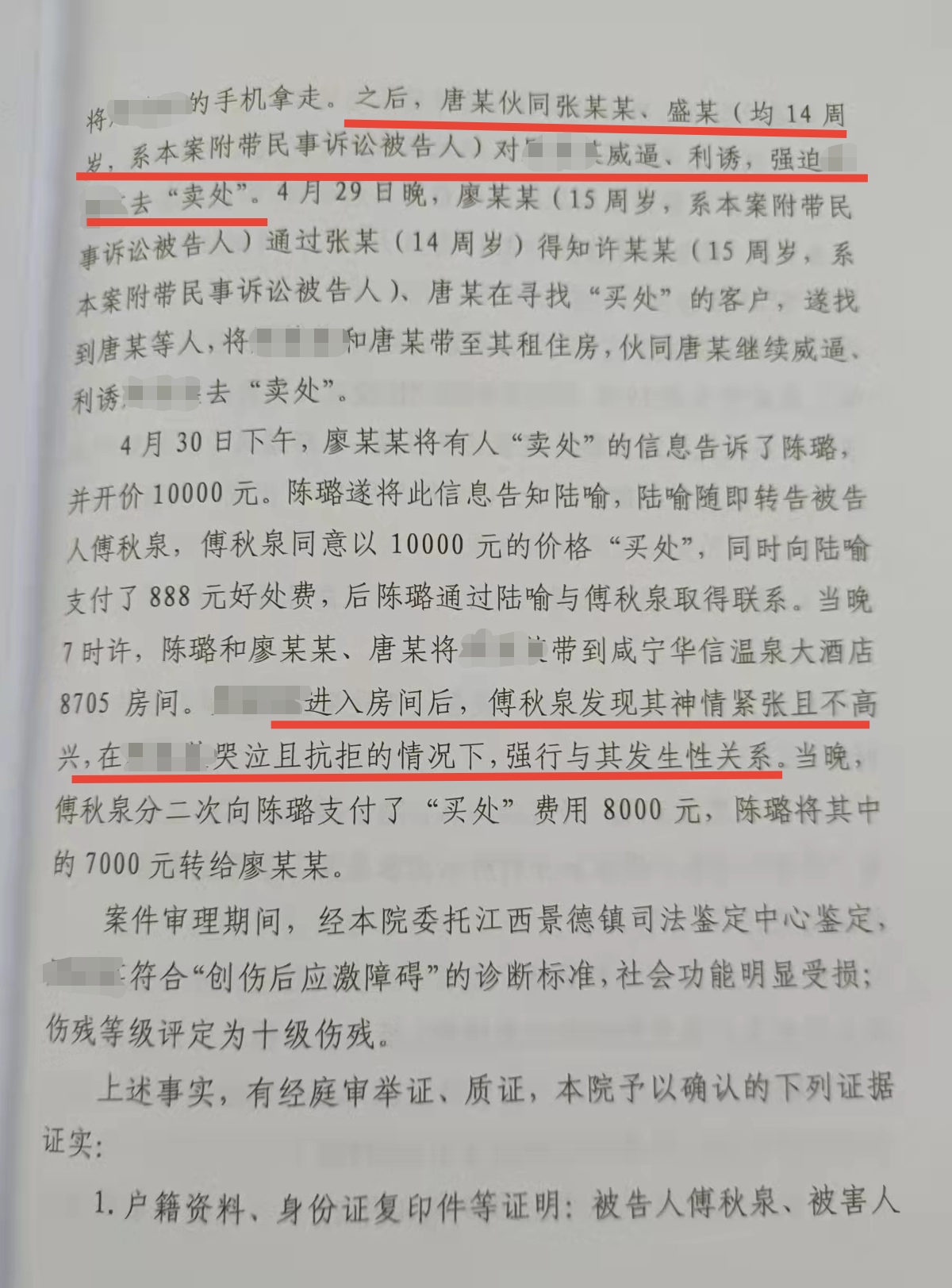

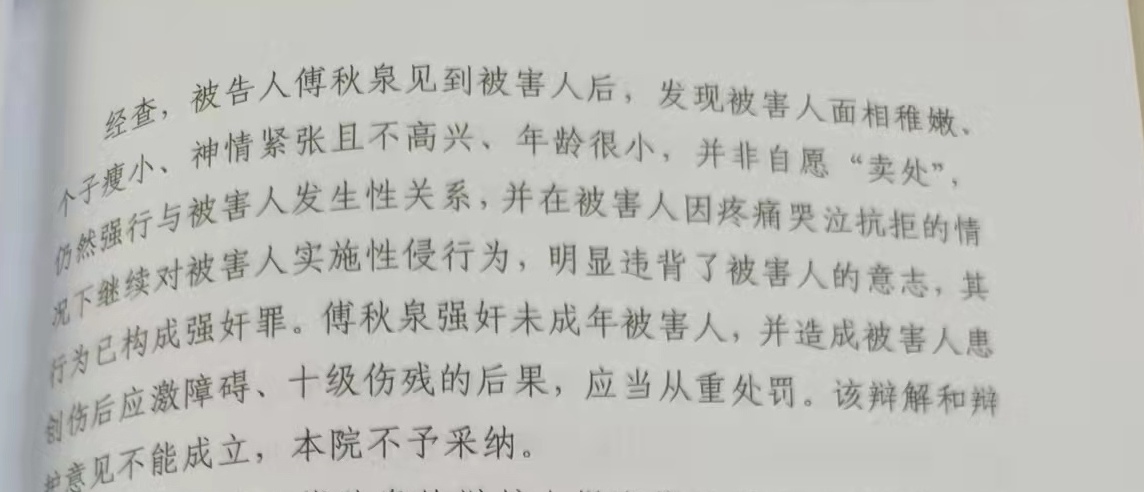

Cases of sexual assault on children are rampant. In early 2023, the Attorney General’s Office of Maryland released a report on the sexual abuse of children in Baltimore Archdiocese. The report recorded more than 600 cases of abuse. According to an analysis by the Associated Press, 19 of the 27 dioceses with a large African-American population in Baltimore’s archdiocese have been accused of sexual abuse by faculty members. However, victims of sexual abuse have little chance to speak. According to data from the Centers for Disease Control and Prevention, more than one in ten American girls said that they had been raped, and high school girls were "swallowed up by more and more violence and trauma".

5. The tragic situation of undocumented immigrants is shocking.

Party struggle has become the background of immigration policy. Politicians ignore the rights and well-being of immigrants and attack each other on the immigration issue, which is unable to improve the resettlement capacity of immigrants in border areas and has no intention to improve the living conditions of immigrants after entering the country. The immigration problem has fallen into a vicious circle of no solution. The humanitarian crisis in the border areas continues to intensify, the border policy encourages modern slavery, and the rights of immigrants are trampled on.

The humanitarian crisis in border areas has escalated. The U.S. government has made a blank check on its immigration policy, which has caused the humanitarian crisis in the border areas to intensify. The southern border of the United States is listed by the International Organization for Migration as the deadliest land migration route in the world. El Paso Times reported on November 30, 2023 that in the 12 months up to September 30, 2023, 149 immigrants were killed in the border patrol area of El Paso alone. Among them, the number of female deaths has more than tripled compared with 2022. Border patrol officers sometimes find two or three bodies every day. A spokesman for the governor of Texas said that what happened in El Paso was the direct result of the chaos caused by the federal government at the border. Fernando Garcia, executive director of the El Paso Border Human Rights Network, accused that government agencies completely ignored the life value of immigrants; The death of immigrants originated from American policy, which is "policy death".

The "pan-throwing" immigration farce was staged on a large scale. CNN reported on December 30, 2023 that since April 2022, Texas, where Republicans are in power, has sent more than 90,000 immigrants to Washington, D.C., new york, Chicago, Philadelphia, Denver and Los Angeles, where Democrats are in power. The website of Brock Club in Chicago reported on October 31, 2023 that since August 2022, more than 19,000 people have arrived in Chicago, which has overwhelmed the city’s reception system. Some immigrants, including children, can only be placed in temporary tents or even sleep in the streets. The Chicago Sun Times reported on October 14th, 2023 that John Yelis, a 6-year-old girl, lived in a temporary tent with an elderly person. With the coming of winter, the cold weather makes them in a difficult situation.

Immigrants are subjected to torture and other inhuman treatment. In fiscal year 2023, the total number of immigrants arrested or deported at the southern border of the United States reached more than 2.4 million, a record high. The United Nations Human Rights Committee expressed concern about the long-term detention of immigrants in the United States, criticizing the harsh conditions and overcrowding in detention centers in the United States, and the detainees could not get food, water and medical services, resulting in many deaths, including children. There are human rights violations such as sexual violence, long-term solitary confinement and abuse in public and private immigration detention facilities. The British Guardian website reported on December 6, 2023 that the Stewart detention center in Lampkin, Georgia, operated by American private prison company CoreCivic, has many worrying problems, such as long-term solitary confinement, sexual abuse, medical negligence and forced labor. On February 15th, 2023, the Innovation Law Laboratory released a report, which revealed that the detention center in Torrance County, Estancia, New Mexico, operated by CoreCivic, tortured detainees. At night, every 15 minutes, a guard walks through these rooms with the radio on at full volume, knocks on the door loudly and shines into the room with a flashlight to wake anyone who may fall asleep. In cold weather, the ventilation ducts in every room blow cold air all night. Some people tried to cover the vents with toilet paper or blankets, but the guards took anything to keep out the cold air. In these cells, toilet sewage and feces overflowed, and people were forced to sleep on the stinking floor.

Border policy encourages modern slavery. The U.S. government’s border policy aggravates the problem of human trafficking. Migrants who are abandoned in towns in border States or transported to all parts of the country are often isolated and vulnerable to exploitation and trafficking. Children who illegally cross the border and gather in crowded and unsupervised shelters have also become prey for traffickers. Among the trafficked people in the United States, 72% are immigrants, most of whom enter the country illegally, and the victims of human trafficking are mostly women and children. A study by the Coalition against Trafficking in Women estimated that 60% of unaccompanied migrant children crossing the border were forced by criminal groups to engage in child pornography and even drug trafficking. On June 18th, 2023, USA Today reported that immigrants were lured by drug trafficking groups to farms in northern California and southern Oregon to engage in marijuana cultivation, and were enslaved and forced to work. Trafficked immigrants are threatened at gunpoint on marijuana farms and forced to work for 16 hours or more every day, sometimes without food. Migrant women were sexually assaulted, some were murdered and their bodies were abandoned in the wilderness. On July 27, 2023, CBS News reported that nearly 60 victims of human trafficking were smuggled to an illegal marijuana plantation in central California, forced to process marijuana, and repaid their debts to the smugglers.

Migrant children are subjected to cruel forced labor and exploitation. The New York Times website published an article on February 25th, 2023, which revealed the fact that American factories illegally employed immigrant children and forced labor. According to the report, since 2021, about 250,000 unaccompanied immigrant children have entered the United States. In order to survive and repay the expenses of sponsors, most children are forced to work and exploited. Migrant child laborers are found all over the dangerous industries in dozens of states, such as construction sites and slaughterhouses. They often work night shifts and engage in dangerous jobs and become "shadow laborers" in the form of economic exploitation. The United States immigration authorities handed over the detained children to the "guarantor" to take them away without reasonable examination, which in fact became a conspiracy of human trafficking. In Alabama, a 12-year-old immigrant girl was forced to work all night in the auto parts stamping workshop; A 12-year-old child was arranged to build a roof the day after he came to Florida. A 13-year-old boy works 12 hours a day and 6 days a week in a chicken farm in Michigan. The legislature played the role of conniving at the exploitation of child labor. The report released by the American Institute of Economic Policy on March 14th, 2023 revealed that in 2023, Arkansas passed new legislation, which abolished the requirement that children have to get permission from their parents to work, and blatantly excused enterprises from hiring migrant children separated from their families.

Six, American hegemony creates a humanitarian crisis.

The United States has long engaged in hegemonism, unilateralism and power politics. Threaten global security and stability with military hegemony, wantonly intervene militarily, stir up regional situation, provoke proxy war, aggravate regional armed conflicts, impose unilateral sanctions indiscriminately, and commit illegal detention and torture in the name of counter-terrorism.

Launch overseas wars and create lasting humanitarian disasters. According to the research report published on the website of the "Cost of War" project of Brown University in the United States in May 2023, after the "September 11" incident, the total death toll in the war zone of overseas "anti-terrorism" war in the United States was at least 4.5 million to 4.7 million, among which the indirect death toll caused by war destroying economy, environment, public services and health infrastructure was about 3.6 million to 3.8 million.

Infringe on the sovereignty and human rights of other countries through the "foreign agent plan". In order to ensure sufficient funds and authority to support foreign armed forces in future operations, the US Special Operations Command promoted a piece of legislation, namely "1208", which was finally written into Article 127e of Volume 10 of the United States Code. According to this law, the U.S. Department of Defense can get a budget every fiscal year to support foreign troops, unconventional armed forces, organizations and individuals who assist the U.S. special forces in carrying out "anti-terrorism" operations. Catherine Jan Ebright, legal adviser of the Freedom and National Security Project of Brennan Judicial Center, pointed out that the U.S. Department of Defense recruits, trains and equips foreign troops and paramilitaries and individuals in accordance with Article 127e, pays them wages, creates agent troops and directs and controls them, so that they can pursue military goals on behalf of the U.S. military. According to the report published on the website of Brown University in September, 2023, the United States has carried out operations called "127e" in Afghanistan, Cuba, Iraq, Kenya, Mali, Somalia, Syria, Yemen, Egypt, Lebanon, Libya, Niger and Tunisia. The New York Times website reported on May 14, 2023, "127e"The project did not supervise and review whether the agent committed human rights violations such as rape, torture and extrajudicial execution when implementing the plan.

Continue to provide weapons to conflict areas. According to the press release issued by the US Department of Defense on July 7, 2023, the additional military assistance worth $800 million provided by the United States to Ukraine contains a large number of cluster munitions. In response to a reporter’s question on July 7, 2023, Deputy Spokesman of the UN Secretary-General Huck said that UN Secretary-General antonio guterres hoped that all countries would abide by the Convention on Cluster Munitions and not continue to use cluster munitions on the battlefield. The website of the United Nations High Commissioner for Human Rights reported on September 20, 2023 that Alice Gil Edwards, Special Rapporteur of the United Nations Human Rights Council on torture and other cruel, inhuman or degrading treatment or punishment, sent an urgent letter to the US government in July 2023, warning that cluster munitions would cause serious harm to civilians. Washington post’s website reported on December 11th, 2023 that US arms flow into Israel for billions of dollars every year, and Israel used US-supplied white phosphorus ammunition in an attack on southern Lebanon in October, causing at least nine civilians to be injured. On October 18th, 2023, Josh Paul, the former director of the the State Council Bureau of Political and Military Affairs, published a column on the The New York Times website, pointing out that the United States provides at least $3.8 billion in military aid to Israel every year, and most of the most serious casualties in Gaza are caused by ammunition provided by the United States, condemning this military aid for ignoring human rights issues. American human rights organization "The Center for Constitutional Rights reported on November 16, 2023 that William Chabasse, an expert on genocide and the death penalty, accused the United States of failing to fulfill its legal obligations to prevent genocide and violating customary international law and the Convention on the Prevention and Punishment of the Crime of Genocide.

The notorious Guantanamo prison is still in operation. The U.S. government has repeatedly promised to close Guantanamo prison, but it has repeatedly reneged. As of 2023, this notorious prison is still in operation. On June 26th, 2023, the UN Human Rights Council’s Special Rapporteur on the promotion and protection of human rights while countering terrorism, Fio Nuara Niolain, concluded his visit to Guantanamo prison, pointing out that there are still about 30 detainees in the prison, and every detainee has suffered continuous injuries and suffered cruel, inhuman and degrading treatment due to extradition, torture and arbitrary detention, so it is urgent to close the prison. The human rights of the vast majority of former detainees continue to be violated, and the US government has serious defects in providing the former detainees with the basic means needed for a dignified life, including legal status, medical care, education, housing, family reunion and freedom of movement. These defects violate the international law obligations of the United States before, during and after the transfer of detainees. On February 16th, 2023, Mansour Adelphi, an artist and activist who was arbitrarily detained in Guantanamo prison for more than 14 years, commented on Al Jazeera website: "After more than ten years of abuse, the United States simply abandoned us without providing any support, care or compensation."

Long-term and indiscriminate unilateral sanctions have caused serious humanitarian consequences. Since 1950, the United States has used the most sanctions in the world. According to the data released by the US Treasury Department on December 28th, 2023, there are more than 20 countries sanctioned by the United States. On November 1, 2023, a spokesman for the 78th United Nations General Assembly pointed out that the economic, commercial and financial blockade imposed by the United States against Cuba violated the Charter of the United Nations and had a devastating impact on the Cuban people. The United Nations General Assembly adopted a resolution on November 2, 2023, once again urging the United States to end the economic, commercial and financial blockade against Cuba for more than 60 years. This is the 31st consecutive year that the United Nations General Assembly has adopted a similar resolution. On January 28, 2023, the United Nations High Commissioner for Human Rights, Volcker Turk, said after her visit to Venezuela that the sanctions imposed by the United States since 2017 have aggravated Venezuela’s economic crisis and seriously hindered the realization of human rights. The "American Conservatives" website reported on June 1, 2023 that US sanctions further aggravated the poverty of the Syrian people. 70% of Syria’s population is facing food shortage, of which 12 million people have no meals and 2.9 million people have no food. On February 14th, 2023, Alena Duhan, Special Rapporteur of the UN Human Rights Council on the negative impact of unilateral coercive measures on human rights, pointed out that the US sanctions against Iran reduced the chances for thalassemia patients to import life-saving drugs from abroad, which led to the increase of complications and mortality of Iranian patients.It is a violation of the right to health. The United Nations Human Rights Council adopted a resolution on April 3, 2023, pointing out that unilateral coercive measures will have a far-reaching impact on the human rights of the broad masses of people in the target countries, especially on the poor and the most vulnerable. The resolution condemns the continued unilateral application of unilateral coercive measures by some big countries. The United States voted against the resolution.

tag

At present, human society is facing unprecedented challenges, and the world once again stands at the crossroads of history. All kinds of human rights problems in the United States not only alienated human rights into the privileges enjoyed by a few people in the United States, but also seriously threatened and hindered the healthy development of human rights in the world.

Quality is better than China, and deeds speak louder than words. Whether we can solve the dilemma of human rights in the United States with ideas and measures that conform to the characteristics of the times and the historical trend, the American people are looking forward to it, the international community is watching it, and the US government has to answer it.