Don’t eat dirt next year, a guide to financial planning for "the last payer"

The 12th year of "Double Eleven" came earlier than previous years. This year, we took the route of "deposit+final payment".

At 0: 00 on October 21st, Tmall Double Eleven Shopping Carnival officially opened for pre-sale. It is reported that on the evening of 20th, the number of online viewers in Viya and Li Jiaqi reached 140 million and 160 million respectively. On the 21st alone, the sales guided by KOL, the two live heads, exceeded 9 billion yuan. From November 1 ST to 3 rd, the first wave of final payment was started. By 1: 51, the turnover of hundreds of brands had exceeded 100 million yuan.

Overnight, the "down payer" became the "down payer". Are you one of them? Do you have impulsive consumption behavior and intend to become a "refund person" after receiving the goods?

When the passion of shopping spree fades, instead of teasing ourselves about "Come on, credit card holders", let’s take a look at how to establish the correct concepts and methods of financial management and consumption, learn to build a stable and safe financial foundation, planning and strategy, and make money "born" stably, so as to ensure that our lives are rich and our old age depends on it. This is the most effective and correct way for the "last payment people" to empty their shopping carts.

Eliminate prejudice and don’t talk about "money"

Some prejudices are closely intertwined with our culture, so they have been internalized into our own views. According to a study conducted by Fidelity in 2016, although most female respondents (80%) said that they deliberately avoided discussing financial issues with the people closest to them. Why? About one-third of people think the following descriptions are true: "I don’t feel well" or "I was taught not to talk about money since I was a child".

At the same time, according to a study conducted by Prudential in the UK in 2016, many women "admit that they are not familiar with financial products and the industry terms describing such products, and feel that they just don’t know what to consider when evaluating alternative financial schemes". They said that they just didn’t have time to understand clearly.

These are all nonsense. If all kinds of financial products confuse you, start by setting up a separate savings account. Think you don’t have time? Get up an hour early every day. You have money, brains and time to change your financial status. Women must know how to make money, save money, make property plans, make investments, maximize the use of money, increase wealth, enjoy wealth and share wealth.

Basic knowledge preparation of financial management: what are net worth, "foundation", "wings" and debt?

We often regard budget and income as the most important aspects in financial management, which means that we have not seen the overall situation, let alone mastered the deep thinking and technology that create things with lasting value.

What’s important, that your overall financial security and your life depend on it?

This golden precious word is: net worth. Together, these two words are the golden key to your personal finance and long-term happiness. Net worth is essentially your real overall value. Add up what you have and deduct what you owe. Its focus is not on short-term income and budget, but on the foundation and wings that support and inspire you for a long time.

What exactly do "foundation" and "wings" mean?

"Foundation" is your basic and main asset; The foundation is your long-term investment project, your retirement pension, real estate, stock securities, and possibly a successful company you own; In some cases, it may also be valuables such as works of art and jewelry. The foundation grows slowly over time. You can’t easily and quickly turn it into cash and spend it at will. They need your regular and periodic attention. Strong long-term assets are the key to net worth because they are difficult to erode. Another reason is that they can accumulate value over time, bring compound interest and make you Qian Shengqian. Properly handled, they can provide protection, just as a strong root system can firmly stabilize a tree.

"Wings" represent your income and your ability to get cash. How high and how far you can fly depends on how much money you have in the money market and savings account, as well as how you spend and use credit. By the amount and frequency of your income and the financial habits that affect your daily life, you can measure your wing width. If used properly, your wings will nest on the foundation with your regular income and any unexpected wealth, fund your foundation and protect it. But wings will also give you the impulse and confidence to take off, and let you soar freely and enjoy life, no matter which direction you choose.

Debt is another common obstacle to improving net worth. Not the debt itself, because most of us have some debts to some extent. What it means is: if your foundation and wings can’t bear your debt burden, then your net worth is negative. That’s the truth.

To calculate your net worth, add up all the assets (what you own) and subtract the loans and liabilities (what you owe on credit) to get your net worth. Reduce debt and increase assets, and your net worth will increase. When you owe less on credit than you have, you begin to own assets. You are moving in the right direction, which is what you need to concentrate on.

Foresight, enjoyment, parenting, independence and production, how to match the five financial types?

Now you have a general understanding of the basic knowledge of financial management, such as the main basic types, but other contents are meaningless until you know who you are and what kind of behavior you may have as an investor.

We all want financial freedom and comfort, but each of us is different. For example, do you long for stability, a beautiful home and integration into the community? If so, then owning a property is the right choice for you. If you haven’t settled down yet, you may consider moving to another city, so you may be more comfortable with long-term investments-you can monitor these portfolios from your mobile phone. In the final analysis, it is to know yourself. So, you must know who you are.

A set of psychological test tools about financial types mentioned in "Going through the Low Valley and Seeing the High Mountain" can let you know your financial talents, strengths and destruction modes. Everyone’s financial type is a combination of the following five, and one or two of them are dominant.

Below, let’s take a look at what type we belong to.

Forward-looking: balancing risks

Foresight people regard money as a tool for self-expression and a means to follow their inner passion, and a symbol of success. If you are a visionary, then you will drive yourself to turn what you love into work. Foresight people like others to realize their own value and invest in their own projects, and they may also take too many risks and suffer financial losses. The challenge faced by visionary people: everything is at risk for future returns, and the current benefits are not built in an orderly manner.

Tang Jing, an elite woman in the workplace in My First Half of Life, has a clear goal and outstanding ability. She perfectly integrates women’s career with the positive pursuit of money. Does she meet your vision of "foresight"?

A visionary TIPS:

Create a safety net

Must have short-term cash reserves. Review your expenses, work out your monthly expenditure baseline, and then try to save enough cash reserves that make you feel at ease (to ensure three months or a year’s expenditure) as your safety net.

Read the contract details

A visionary must read the contract details and do some due diligence before cooperating with investors and supporters. Make sure you know all the terms before signing. You can seek help from professionals such as lawyers or financial planners.

Don’t forget taxes

If you do part-time creative work while working full-time, make sure to set aside some savings to pay taxes, so that your creative work will not face any unexpected consequences.

Balance risks

We must understand the risks involved in investment projects and try to balance the risks in investment-consider diversified investment portfolios.

Suitable for far-sighted financial foundation: retirement account, self-founded company.

Hedonic: Feeling inspired, not down and out.

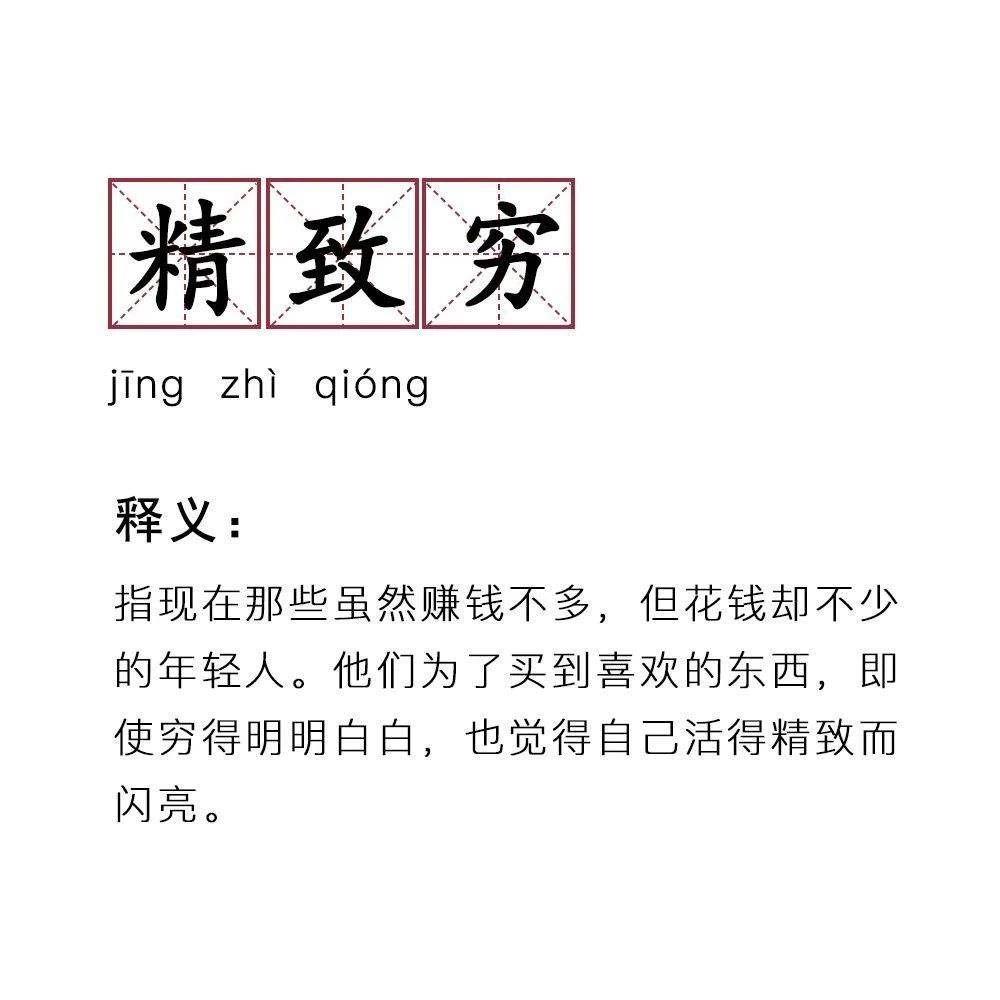

Hedonists love money. They love consumption, and their main consumption targets are material goods, services and experiences. They may even enjoy saving money. Hedonic people seek a better life, and the standard of "superior" is defined by themselves. Challenges faced by hedonists: They usually want to enjoy themselves now, and it is difficult to postpone their enjoyment until later. They may start a sideline or work overtime so that they can buy experiences and luxuries that make them feel happy.

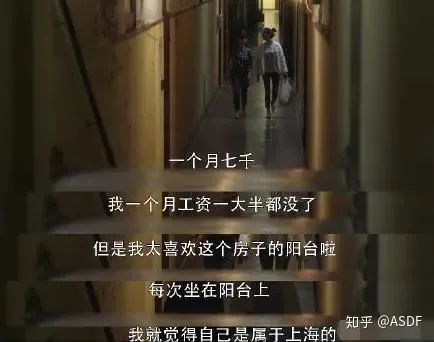

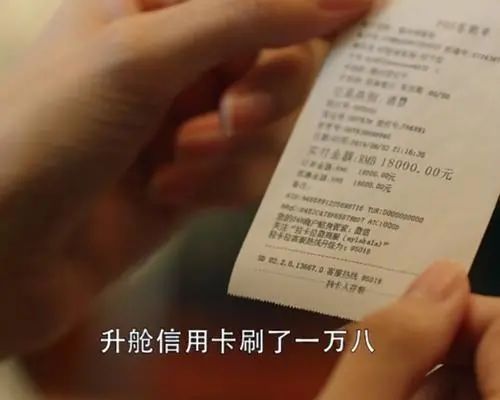

Mani, a floating king in Nothing But Thirty, has a monthly salary of 15,000 yuan, a monthly rent of 7,000 yuan and a credit card of 18,000 yuan for travel upgrade. Some people say that this is "exquisite and poor" with the characteristics of "hedonism". What do you think of this?

Hedonic people TIPS:

Pay attention to conscious consumption targets.

Choose the items and experiences that you are eager to buy, and take them as goals to save. Make sure that both short-term and long-term goals are set. Concentrate on your reward system and let your savings inspire you, not make you feel down and out.

Save money before spending it.

Save automatically every month and open an internal "paycheck"-after you allocate the money for saving and fixed expenses, give yourself a salary and let yourself spend the money with peace of mind and freedom.

Review the expenditure in the past 3 -6 months, clearly understand your consumption items, and determine which are "core expenditures" or needs. Rank these pleasures in order of importance, and stick to this ranking table.

:: Rethinking priorities

Be careful about debt financing. If you are already in debt, give priority to those credit cards with the highest interest rate.

Financial foundation suitable for hedonism: retirement account, real estate.

Parenting: giving priority to others

Parenting people regard money as a tool to help others, whether it is their partner, children, family, colleagues, employees or the community. Their first task is to support their families well. If you are a nurturing type, then you value interpersonal relationships most, and you will consider others when making financial decisions. If your main concern is to care for others and cultivate relationships, then you belong to the nurturing type. Parenting people may inadvertently invest too much money in supporting others, so that their financial needs can not be met. The challenge for nurturing people: give priority to and continue to invest in themselves.

Fan Shengmei in Ode to Joy is a senior HR in a foreign company. She has a strong ability to be loyal to others, but she is forced to support her family and bear great financial pressure. This passive "nurturing type" should arouse the reflection of women and the whole society.

Parenting people TIPS:

Give priority to helping yourself to help others more.

Remember what the flight attendant said to you when you eagerly sent a text message and tried to shove your handbag under your feet: "Wear your own oxygen mask before helping others."

Don’t get into debt for others.

Don’t use credit cards to raise money to buy gifts or lend money to your loved ones. If you find yourself helping many people solve economic problems, then you need to redefine what an emergency is and set clear boundaries.

Give priority to yourself and maintain healthy interpersonal relationships.

Develop a funding budget

Make a goal-oriented plan, so that you can support people and causes you trust without getting into danger.

Financial foundation suitable for parenting: retirement account, real estate.

Independent type: attaching importance to autonomy

Independent people attach great importance to freedom and autonomy. If you are independent, it is important for you to live in your own way and pursue happiness freely. Independent people often don’t think much about money unless it prevents them from getting the life they want. Independent people may have an attitude of "easy come, easy go" towards money, but this is because they have resources-they look at the overall situation and are confident that they can play money games. At the same time, independent people may inadvertently lack attention to money, resulting in some avoidable financial problems. The challenge for an independent person is to realize the real function and influence of money-and its various possibilities.

Andy in Ode to Joy is an investment company executive and business elite. He is confident that he can play money games without being tied down and attaches importance to autonomy. He is a typical "independent type".

More ambitious plans for independent people:

Rethink your view on money.

Leave detailed analysis and planning to others, so as to reduce some pressure and anxiety caused by financial decision-making and planning.

Try socially responsible investment.

If you feel that investment is too corporate, and the scale is easy to fail, then you can consider socially responsible investment. After screening, your portfolio will exclude stocks of companies that are contrary to your values.

[Editor’s Note: socially responsible investment (referred to as "SRI") is an investment model that unifies investment decisions with economy, society and environment, aiming at prompting investors to consider social welfare, economic development, world peace and environmental protection in addition to traditional monetary returns]

Take a step towards a more secure future.

Save now and make good use of relevant policies, so in the future, you may not have to continue working, but have the ability to sail with the wind. If you are self-employed, do some research (or hire a financial planner) and make the best retirement plan. If the company you work for offers a retirement plan, set it to automatically pay a considerable amount to it.

Set to automatic driving mode

The more you can put your savings and expenses, especially bill payment, into autopilot mode, the more time you have to enjoy a quality life.

Suitable for independent financial foundation: investment, self-founded company.

Production: Structure and Control

Productive people like to acquire, manage and accumulate money, but they are afraid of heavy losses in money or losing control of money. They will systematically evaluate their financial decisions. If you are very strategic and like planning, then you are probably a production type. You can understand spreadsheets and practical goals, so most types of foundations are suitable for you, except running a company. First, you should concentrate on building retirement savings. Then, you can get in touch with real estate and investment. Challenges faced by productive people: being too rigid about what is possible or can be done.

Nothing But Thirty’s Gu Jia Shuangshang has strong online ability, is very strategic and loves planning, and keeps the company in good order with the characteristics of "production"

More ambitious plans for productive people:

Establish a moderate safety net

Compound interest may make you overexcited and put too much money in the bank. Clearly understand how big the safety net you really need, and then build a portfolio to make the rest of your savings more useful to you.

Don’t lose money (because of inflation)

After establishing short-term savings funds, consider investing in a portfolio that fits your investment period, future goals and risk tolerance level. You don’t have to jump from super conservative to super enterprising, you just need to work with professionals to understand how your portfolio should be improved.

Freelancers, plan for the future.

If you are self-employed, make sure that your retirement plan allows you to maximize the growth brought by deferred tax payment. If the company you work for has a retirement plan, reconfirm which funds you have invested in.

Financial foundation suitable for production: retirement account, real estate.

This article is compiled from "Going through the Low Valley and Seeing the High Mountain: A Guide to Financial Planning for Women" (by Amanda Steinberg, published by CITIC Publishing House in October 2020). The copyright belongs to the author and this book. Please indicate the author and the source of the work in the serialization.