Another smart driving supplier to Hong Kong IPO! Xiaomi injected capital and lost nearly 1.6 billion in three years.

Author | Your Words

Editor | Zhihao

On the same day that Xiaomi SU7 went public, Zongmu Technology, a supplier of autonomous driving solutions, submitted a listing application to the Hong Kong Stock Exchange!

On April 4th, news of Chedongxi, recently, Zongmu Technology (Shanghai) Co., Ltd. (hereinafter referred to as "Zongmu Technology"), an intelligent driving solution provider funded by Xiaomi, officially submitted a prospectus to the Hong Kong Stock Exchange, with Huatai International and BNP Paribas as co-sponsors.

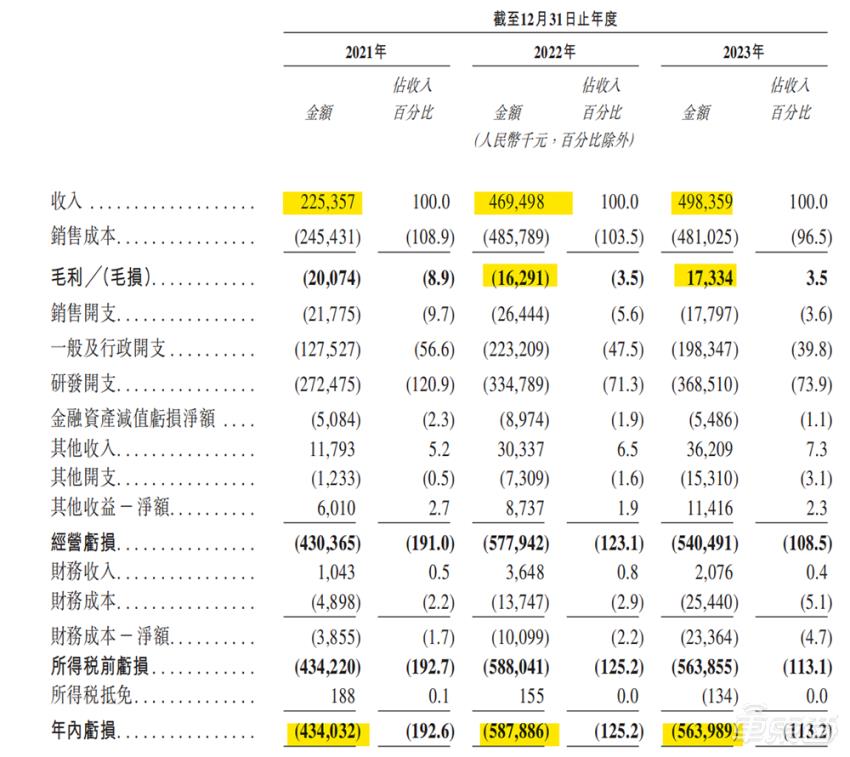

According to the IPO documents provided by Zongmu Technology, Zongmu Technology’s revenue has continued to grow in the past three years, achieving revenue of 225 million yuan, 470 million yuan and 498 million yuan respectively, and accounting for nearly 500 million yuan last year. In three years, the losses of Zongmu Science and Technology were about 434 million yuan, 588 million yuan and 564 million yuan respectively, and the losses in three years were nearly 1.6 billion yuan.

▲ Looking at the IPO documents submitted by HKEx.

According to the prospectus, Zongmu Technology is an ADAS solution provider in China, which provides solutions covering all-round autonomous driving functions with advanced autonomous driving technology.

The company also uses the company’s expertise to develop self-driving energy service robots, mainly providing intelligent mobile energy solutions for property operators. As a first-class supplier, the company is involved in all aspects of the autonomous driving field, including software design, hardware design, system design and the integration of these components, thus developing a solution that can be deployed on a large scale.

At this stage, whether the ammunition depot is sufficient and whether the funds are abundant has almost become the key criterion for whether the upstream and downstream of the autonomous driving industry chain can survive the "cold winter".

Zongmu Technology, which was established in 2013, submitted an application for listing to science and technology innovation board as early as November 2022, but the road to listing was not smooth. Zongmu Technology withdrew the application in September 2023 and planned to list on the Hong Kong Stock Exchange. Last week, Zongmu Technology officially submitted the form to the Hong Kong Stock Exchange for listing.

First, the compound growth rate of revenue is nearly 48%, and the gross profit margin has turned from negative to positive.

Looking at the IPO document of Zongmu Technology, it is found that as a leading intelligent driving solution provider in China, a number of financial data of Zongmu Technology have continued to develop well in the past three years.

In the past three years, the revenue of Zongmu Science and Technology has continuously increased, reaching 225 million yuan, 470 million yuan and 498 million yuan respectively, with a compound annual growth rate of about 48.7%.

▲ Zongmu Technology’s revenue has continued to grow in the past three years

As far as the specific business is concerned, Zongmu Technology’s main business is the field of automatic driving, including software, hardware, system design and component integration. The company’s comprehensive intelligent driving solution supports automatic parking from L2+ level to automatic driving, and its Drop’nGo platform supports the development and iteration of intelligent driving functions from L0 level to L4 level.

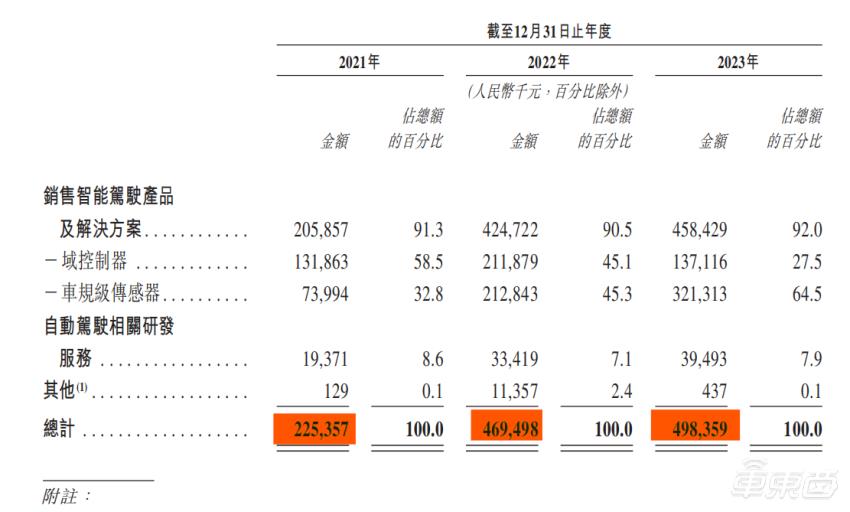

According to the IPO documents, more than 90% of Zongmu Technology’s revenue comes from the sales of intelligent driving products and solutions, which account for about 91.3%, 90.5% and 92.0% of the total revenue in 2021, 2022 and 2023 respectively.

In the same period, Zongmu Technology’s revenue from smart driving products and solutions increased from 206 million yuan to 458 million yuan, with a compound annual growth rate of 49%.

In addition, the related products of Zongmu Technology have also got a good ranking in the industry: Zongmu Technology ranks fifth in the ADAS (Advanced Driver Assistance System) market, with a market share of 1.0%; Ranked second in the automatic parking solution market, with a market share of 4.9%; It ranks first in APA (Automatic Parking Assistance System) market, with a market share of 5.6%.

In terms of losses, the company’s losses during the year were about RMB 434 million, RMB 588 million and RMB 564 million respectively. The adjusted net losses were 382 million yuan, 477 million yuan and 516 million yuan respectively.

Of course, the executives of Zongmu Technology have made a public statement about this persistent loss because "the chip is too expensive".

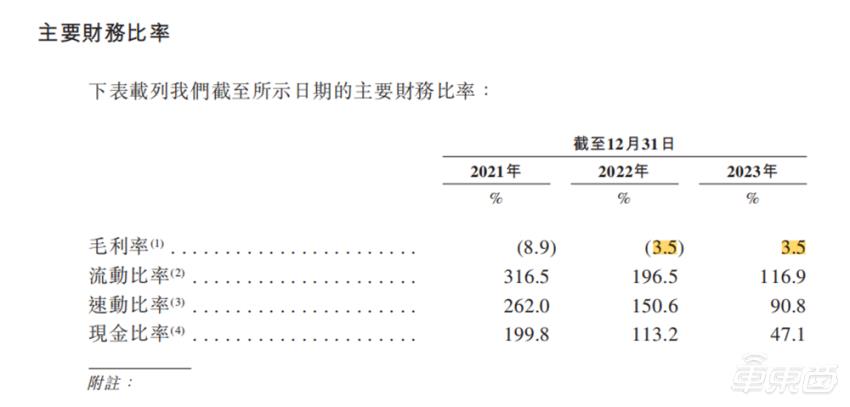

In addition to these, one of the biggest highlights of this document is that Zongmu Technology has achieved a positive gross profit margin in the past three years. From 2021 to 2023, the gross profit margins achieved by Zongmu Technology are -8.9%, -3.5% and 3.5% respectively, which shows the sustainability of the business model of Zongmu Technology.

▲ Changes in gross profit margin of Zongmu Technology in recent three years

Second, 74% of the top ten OEM fundraising will be used for research and development.

The gross profit margin of Zongmu Technology has changed from negative to positive, and behind the rapid growth of revenue is the huge customer base of Zongmu Technology.

On the market side, the prospectus shows that during the track record period, Zongmu Technology has carried out business cooperation with all OEMs with the top ten sales volume in China in 2022 (accounting for 72.1% of the total sales volume of passenger cars in China market) and many other major new energy automobile brands in China. At present, Zongmu Technology is deploying intelligent driving solutions for 50 models.

The support of users is largely due to the technical ability of Zongmu Technology.

According to this IPO document, in terms of R&D investment, in 2021, 2022 and 2023, the R&D expenditure of Zongmu Technology was 273 million yuan, 335 million yuan and 369 million yuan respectively. By December 31st, 2023, there were 524 R&D teams, accounting for 58.2% of the total employees.

With the IPO of Zongmu Technology, Zongmu Technology has determined the use plan of the preparatory funds for this landing on the Hong Kong Stock Exchange. It is reported that 74% will be used for research and development in the next three years, mainly focusing on "investing in the shared equipment and infrastructure of development projects, investing in the development of a new generation of Drop’nGo platform, investing in the development of integrated solutions for parking and navigation, and investing in the development of energy service robots.

In terms of shareholder composition, Xiaomi’s shareholding ratio is 4.73%, making it the fifth largest shareholder of Zongmu Technology. In addition, Zongmu Hong Kong holds 22.17% and Junlian Chengye, a subsidiary of Junlian, holds 7.55%.

Conclusion: China’s intelligent driving industry chain has hit the market.

As an autonomous driving technology enterprise with artificial intelligence technology as its core, Zongmu Technology has been committed to providing cost-effective intelligent driving solutions since its establishment, and has been widely recognized by the outside world in terms of technology, products and solutions.

At present, cash players from many self-driving tracks, such as Horizon and Black Sesame Intelligent, have rushed to the capital market, with the intention of using external capital to consolidate ammunition.

Players in the smart driving industry chain represented by Zongmu Technology are continuing to push forward the listing process. In this process, players in the China industry chain are expected to gain more sufficient capital reserves, touch a broader global market and bring long-term return potential to investors.