How can individuals participate in the investment when the first batch of stocks in science and technology innovation board are listed and traded on the 22nd?

Beijing, July 22nd (Reporter Qiu Yu), the client of Zhongxin. com, lasted only 259 days! Since its establishment was announced on November 5, 2018, the first batch of 25 companies in science and technology innovation board were listed on July 22, 2019, that is, science and technology innovation board shares can be officially traded.

Science and technology innovation board’s stock trading rules are quite different from the current A-share rules. Since there is no limit on the price increase and decrease in the first five trading days, how the intraday stock price will fluctuate has attracted much attention. So, how do individual investors participate in science and technology innovation board? What problems should we pay attention to?

How do individual investors participate?

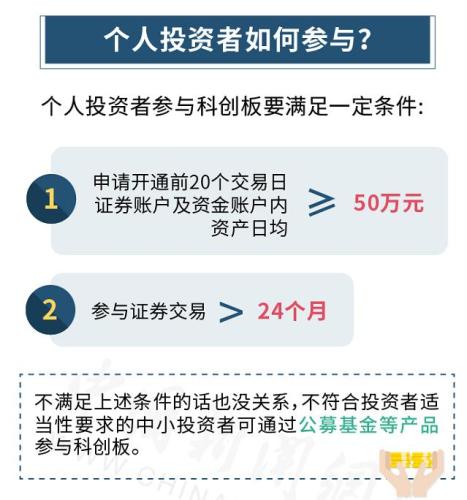

If individual investors want to participate in science and technology innovation board stock exchange, there is a certain threshold, and they need to meet the following conditions:

The daily average assets in the securities account and capital account in the 20 trading days before the opening of the application authority are not less than RMB 500,000 (excluding the funds and securities that the investor has integrated through margin financing and securities lending); Participated in securities trading for more than 24 months.

In other words, you must have not only two years of experience in securities trading, but also at least 500,000 yuan in your account. The relevant person in charge of the Shanghai Stock Exchange said at the end of June that there are about 3.2 million investors who meet the requirements of appropriateness.

It doesn’t matter if the above conditions are not met. According to the Shanghai Stock Exchange, small and medium-sized investors who don’t meet the requirements of investor suitability can participate in science and technology innovation board through products such as Public Offering of Fund.

At present, Bosera Fund, Yin Hua Fund, Dacheng Fund, China Europe Fund, Caitong Fund, CICC Fund and other fund companies have launched science and technology innovation board-related theme funds.

How do individuals participate in innovation?

Playing new means that investors use funds to participate in the subscription of new shares. If they win the lottery, they will buy the shares that will be listed soon, mainly through online and offline channels.

Since the offline subscription object does not include individual investors, for ordinary individual investors, they can only participate in innovation through online subscription.

If you want to purchase online, the first step is to open the science and technology innovation board trading authority, that is, to meet the above conditions.

The second step is to meet the requirement of holding market value, that is, the total market value of the unrestricted A-share shares and unrestricted depositary receipts held by individual investors participating in the subscription of new shares in science and technology innovation board is more than 10,000 yuan (including 10,000 yuan).

For example, if you have bought more than 10,000 yuan of Shanghai Pudong Development Bank (stock code: 600000.SH) shares in your stock account, and meet the above conditions for participating in science and technology innovation board, you can participate in the IPO in science and technology innovation board. Because the stock codes 601 and 600 start with the Shanghai Stock Exchange. The stock at the beginning of 000 is the main board stock of Shenzhen Stock Exchange; 002 starts with small and medium-sized stocks of Shenzhen Stock Exchange, and 300 starts with GEM stocks of Shenzhen Stock Exchange.

In addition, there is another way to invest in bank wealth management and fund participation in innovation. For example, at present, Bank of China, China Merchants Bank, Postal Savings Bank and other banks have launched science and technology innovation board-themed bank wealth management products, mainly by investing in innovative funds to indirectly participate in innovation in science and technology innovation board.

Are new shares "bought as earned"?

Many people think that buying new shares means earning, just like winning the lottery. The data shows that the number of investors participating in online innovation has exceeded 3.1 million. This means that almost all individual investors who have opened the trading authority in science and technology innovation board have participated in the innovation.

In fact, science and technology innovation board’s new shares are not cheap.

Price-earnings ratio (PE) is the ratio of stock price divided by earnings per share, and it is one of the most commonly used indicators to evaluate whether the stock price level is reasonable. Generally speaking, the higher the P/E ratio, the more overvalued the stock is.

The upper limit of 23 times P/E ratio has been cancelled in the issue price of science and technology innovation board shares, so the average P/E ratio obviously exceeds the overall level of A shares.

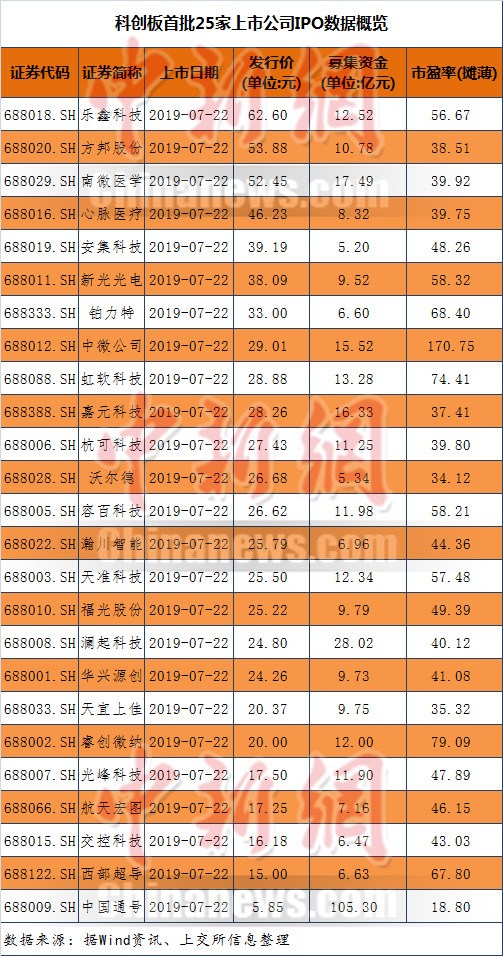

According to the statistics of Pacific Securities Research Report, the P/E ratio of 25 companies is between 18.86 and 170.75 times, with an average of 49.16 times and a median of 42.14 times.

Among them, the highest P/E ratio is Zhongwei Company, 170.75 times; The lowest is China’s through number, 18.8 times. The P/E ratios of China Tonghao, Wald, Tianyi Shangjia and Aerospace Hongtu are lower than the industry level, and the remaining 21 companies are all higher than the industry valuation.

Judging from the issue price, according to Wind data, the average issue price of the first batch of 25 new shares listed in science and technology innovation board is 29.20 yuan/share. As of July 15th, of the 87 A-share new shares issued this year, only 21 were issued at a price exceeding 29.20 yuan/share.

In addition, in terms of winning rate, the average winning rate of the first batch of 25 science and technology innovation board new shares is nearly 0.06%, which is higher than the overall level of A shares.

What problems should we pay attention to in trading?

Science and technology innovation board’s trading rules are different from the current rules of A shares.

First, the price rises and falls. There is no price limit in the first five trading days after the listing of science and technology innovation board stock, and a 20% price limit is set from the sixth trading day.

In the first five trading days, science and technology innovation board also set up a temporary suspension system. When the intraday share price rises or falls by 30% or 60% compared with the opening price for the first time, it will be suspended once respectively.

In this regard, some market analysts have warned that if there is no price increase or decrease, it is very likely that investors will be "hung at high altitude" after buying; The price limit of 20% is twice as large as the current limit of 10% A shares, and the trading risk is higher.

Secondly, the number of single declared shares in science and technology innovation board is different from the current 100 shares in A shares, and its starting number is 200 shares. Moreover, as long as each declaration exceeds 200 shares, it can be increased by 1 share, for example, 201 shares and 202 shares can be purchased.

Finally, it should be noted that science and technology innovation board has not introduced the T+0 trading system, but still adopts T+1. T+1 means that stocks bought on the same day cannot be sold on the same day, and cannot be sold until the next trading day.

The relevant person in charge of the China Securities Regulatory Commission said earlier that at this stage, China’s capital market is still immature, the proportion of small and medium-sized retail investors in the investor structure is relatively large, the characteristics of the unilateral market have not fundamentally changed, and the market monitoring means are still insufficient. Starting from maintaining the stable operation of the market and protecting the interests of small and medium-sized investors, science and technology innovation board has not introduced T+0 trading system yet.

What is the impact on the trend of A-share main board?

Essence Securities pointed out that assuming that the turnover rate of most companies in science and technology innovation board reached 89% on the first day of trading, it is estimated that the turnover of science and technology innovation board on the first day will be about 31.394 billion yuan (assuming that the average transaction price exceeds the issue price by 35%), then science and technology innovation board will account for about 6.56% of the total turnover of the two cities, with little liquidity impact.

Huatai Securities analyzed that science and technology innovation board’s influence on the liquidity of the A-share main board mainly has two aspects, namely, the bottom warehouse drainage effect and the diversion effect.

On the one hand, science and technology innovation board’s increase in stock supply has created a certain diversion pressure on the trading volume of the existing A-share sector, which is in the two stages of issuance and listing; On the other hand, participating in the subscription of science and technology innovation board new shares requires the market value of A-share bottom positions, which is expected to increase the allocation funds of existing sectors.

Regarding the "diversion pressure on the existing A-share sector", GF Securities believes that the diversion effect brought by science and technology innovation board is limited and controllable due to the comprehensive mechanism and volume factors.

From the mechanism point of view, the Growth Enterprise Market (GEM) adopted the new subscription of new shares in advance, and the first batch of frozen subscription funds reached one trillion yuan, while science and technology innovation board only adopted the market value placement method, which greatly weakened the diversion effect; In terms of volume, the financing scale of science and technology innovation board is expected to be 80 billion to 90 billion yuan in 2019, and the overall pace is controllable.

Li Chao, vice chairman of the China Securities Regulatory Commission, said earlier that science and technology innovation board has strict corresponding standards and procedures, which does not mean that anyone who wants to go public can go public. At the same time, science and technology innovation board pays attention to the market mechanism, which includes market constraints. As long as all parties in the market, including intermediaries, issuers, investors, and regulatory authorities, return to their posts and do their duty, I believe there will be no flooding in science and technology innovation board. (End)