White Snake: Success or Trial-and-Error of the New Opera Film?

The blue word cultural industry reviews above the point pay attention to and star the standard.

In recent years, reviving the traditional national trend has become a major trend in China’s cultural creation. Excellent works such as The Return of the Great Sage, Ne Zha, which was born in the horn of "cultural self-confidence and cultural innovation", have repeatedly recorded box office records. A song "The Banquet at the Tang Palace" has brought countless audiences back to the Tang Dynasty, and Deyun Society has also made the cross talk that is on the verge of dying reappear in spring. Drawing on the tradition and giving new life to the creative way, the old tree of traditional culture, which has been dusty for a long time, opens new flowers. White Snake, as a new attempt of drama film, can the two elements of new technology and traditional drama collide with each other to illuminate the distant stars? This issue of Cultural Industry Review (ID: WHCYPL) takes you to discuss.

author| Wang Yixuan Chen Xizhuo (Cultural Industry Review Author Group)

edit| Feng Jiaxin

source| Cultural Industry Review

The text is 5624 words in total | Estimated reading time is 15 minutes.

The ancient city is full of smoke and waves, ink painting is poetic, one umbrella holds up the rain, and two sleeves dance for affection …

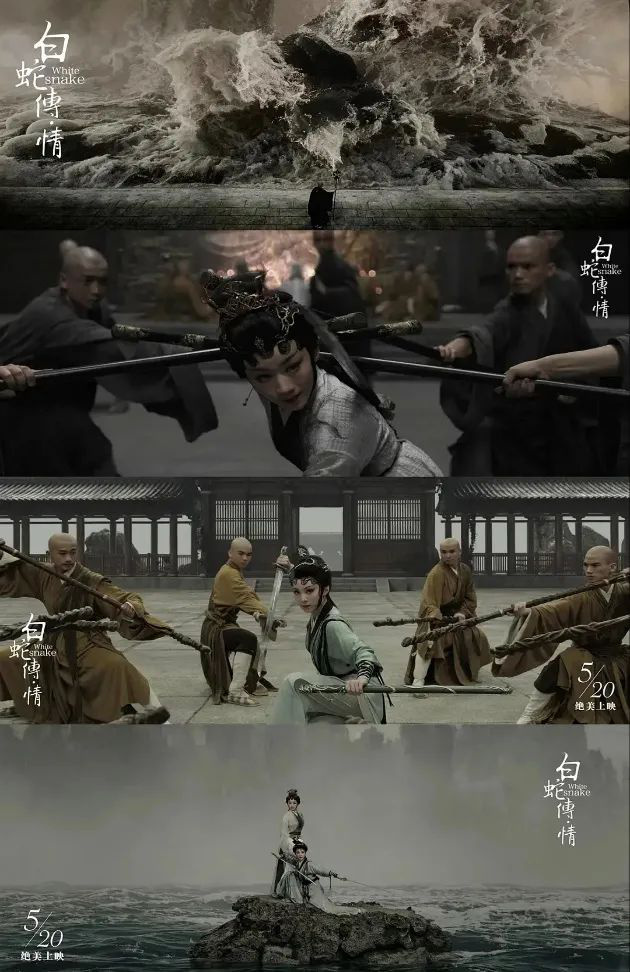

As soon as the final preview of White Snake, which claimed to be "China’s first 4K panoramic Cantonese opera movie", was released, it rushed to bilibili and other multi-platform hot searches, which set off a discussion upsurge, and the praise of "amazing" and "beautiful" was wildly screened.

Not only is it a preview, but the word-of-mouth of the feature film also lives up to expectations. Before its release, this film has successively won the award of the third Pingyao International Film Exhibition, Window of Genre, the most popular film, the best opera film nomination award of the 32nd Chinese Golden Rooster Award and the best technology award of the 2nd Hainan Island Film Festival.

By May 29th, White Snake has become the film with the highest score in Chinese in Douban in 2021. Only more than 10,000 viewers have seen it, and White Snake scored 8.2 points. Compared with Hi, Mom, which has a million points, it is somewhat watery. However, it has been released for more than a week, and the top three popular movies have been rotated many times. White Snake is still among the top three real-time popular movies, which indirectly shows the word-of-mouth fermentation and public recognition.

From the pre-heating to the release, many official media have also paid attention to and affirmed. White Snake is undoubtedly a dark horse of traditional Chinese opera films, and has been endowed with great significance in opening up a new road for traditional Chinese opera films. How did this dark horse bring the traditional opera on the verge of "dating" back to the public eye?

Four Eye-catching Points in White Snake

Beauty of ancient scenery

After the release, White Snake maintained the same high standard as the final preview, showing the beauty of China’s classical scenery. Square and round architectural aesthetics, in the embrace of rain and Gu Teng Castle Peak, outline the ancient town of Hangzhou to the extreme. The water wave reflects the canoe, and the lotus is smiling with beads, which is the beginning of the encounter; Red plum branches, plain clothes holding hands, carved columns looking far away, is a deep affection together; The flying cliff is covered with snow, and the ancient temple is stained with ink, which is the majesty of heaven and law.

Play and fight.

There are infatuated scenes and action scenes that make the audience adrenaline surge. For the first time, lady white snake saved her husband and contributed to the scene of fighting swords with Helu Erxian Snow Mountain. The figure is elegant, the sword is sharp, and the lens of the two immortals turning into cranes and deer is more Chinese fantasy.

Lady white snake saved her husband from entering Shaolin for the second time, and took turns to show the Buddhist monk array, dancing sleeves and sticks, the water flooding the golden hill, and standing on a stick to set the water … Close and unrepeatable action dramas and big scenes came one after another, which deduced the classical drama to the extreme. The original traditional opera martial arts that did not pursue violent aesthetics could also make the audience feel nervous and exciting.

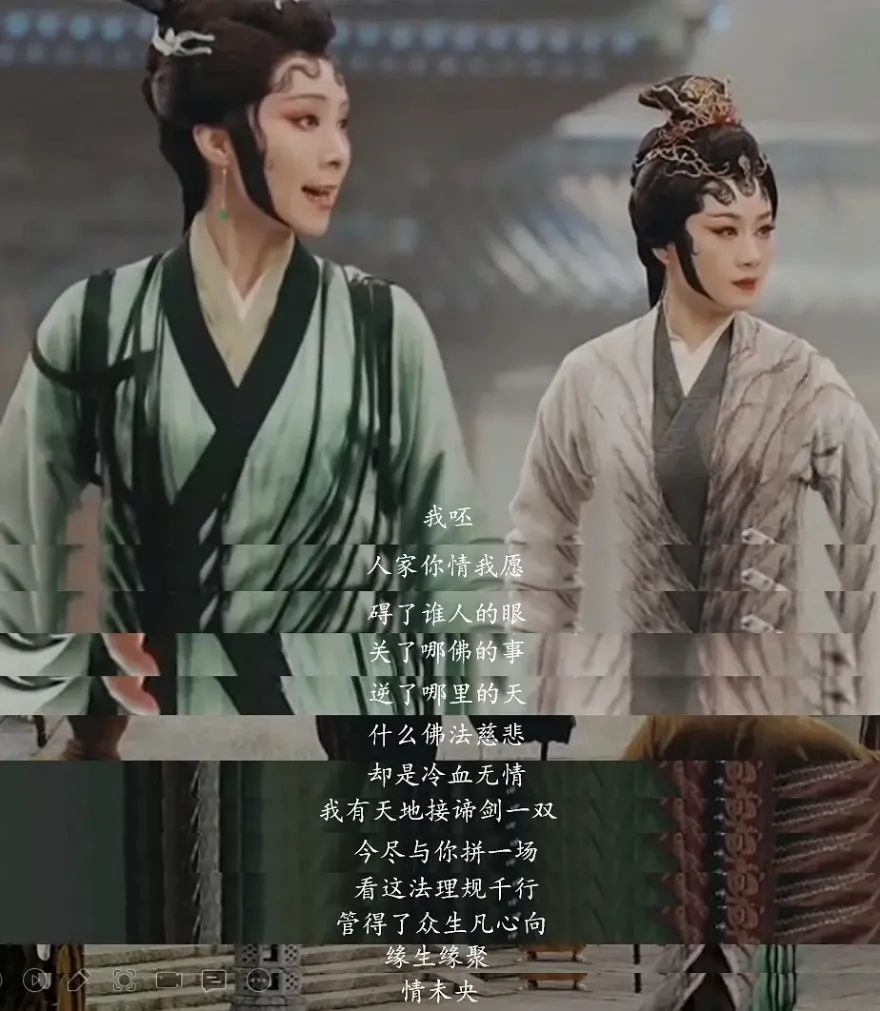

The amazing singing

The lines of the whole film are "sung", and the opera actors have a solid foundation, a beautiful and long singing rhyme, and all the joys and sorrows are between the openings. This also shows that this is a hardcore opera movie, with a cluster of characters, gestures and singing, which gives the audience who are fresh in reading opera movies a brand-new viewing experience.

New theory of value

There have been many versions of the legend of White Snake, most of which only write about the feelings of shemale, and the Buddha and the White Snake are absolutely opposite. However, this edition shows the new connotation that everyone who has a heart has feelings. The two immortals, Crane and Deer, let lady white snake take away the immortal grass that has been protected for a hundred years, and the little monk privately let Xu Xian go to reunite with lady white snake. Even Fahaidu showed leniency, and did not punish the little monk who privately let Xu Xian, and finally left everything to heaven to decide. "If a person is ruthless, he is not as good as a demon. If a demon has feelings, he is also a human being." Although it was said from Xu Xian’s mouth, it was a common awakening for all.

At the same time, the image of a woman who dares to love and hate, is not afraid of power, and actively strives for it, which also conforms to the creative trend of today’s "women’s enthusiasm".

Due to its own limitations, it is difficult for traditional Chinese opera films to get out of the circle. For ordinary audiences, White Snake, who wears the skin of an ancient fantasy heroine and retains the essence of traditional Chinese opera, made a stunning appearance and became the first choice of into the pit traditional Chinese opera films. The four eye-catching points are enough for the ordinary audience to move, so it is not surprising that the notice will be searched on fire as soon as it comes out. How was this spectacular feast of national style created? Behind it lies the attitude of the creators towards the adaptation of traditional operas. Whether its future is bright or dark, can it carry the banner of the revival of traditional operas?

Singing and playing by the west lake, the origin of love gathering in the misty rain

When the eyebrows are opened, it is divided into good and evil, loyalty and treachery. An empty platform shakes the soul and bones, eliminating the complicated scenes. The curtain that rises and falls is the fleeting flight from the Shuixie Song Platform to the battlefield of thousands of miles. Being in an "empty door" does not hide one’s intentions, and the coordination of singing and body movements can show the choppy waves, galloping horses, colorful wings and changeable situations. A few people can make a play with one set, relying on the extreme coordination of expression, movement and opera cavity. The simple stage gives the audience the most comprehensive imagination in a way out of thin air. The audience has long been immersed in it, and the more abstract it is, the more it can stretch the actors’ bones and show their true meaning.

Abstract art has become a minority in today’s society. Audiences who have been baptized by fast food blockbusters and high-scoring drama films are getting farther and farther away from traditional operas, unable to understand actions and lyrics, and are even more confused about the story. The abstract action performance runs counter to the real visual experience pursued by the younger generation. Under the general trend of "seeking truth", traditional Chinese opera is in danger of "dating".

This important task of survival was left to White Snake, a newly-edited legendary Cantonese opera. This Cantonese opera is divided into five scenes: Love-unusual love-Begging-Injury-Continuing Love, which reinterprets The Legend of the White Snake, starring Zeng Xiaomin, winner of the Plum Blossom Award for Chinese Drama and Wenhua Performance Award, and Wen Ruqing, a national first-class actor. Once staged, it won high praise. This Cantonese opera successfully went out of Guangzhou and toured the whole country, including Beijing Mei Lanfang Grand Theatre and Xi ‘an People’s Theatre, and it was packed.

Among them, the tour of the lake was staged on the CCTV Spring Festival Evening in 2021.

The story of The Legend of the White Snake is a household name, and it has its own fantasy color. The public has a low threshold for entering the drama with this story, and they don’t need to have a high level of traditional Chinese opera culture. The popular story makes it possible for the traditional Chinese opera culture to move down.

Cinematization: driving the public to play with the eye

Rendering Suzhou and Hangzhou with Technology

The "documentary" mode that only shoots the stage can only meet the needs of the old opera fans, and in essence, it is to copy and paste the original, while the way of shooting the real scene may be "inconsistent" with the opera performance that runs through the audience, and the opera cavity and artistic body movements will be incompatible with the real scene. How to balance freehand brushwork drama and realistic film is a big difficulty. In order to attract outsiders, director Zhang Xianfeng decided to "use western film technology to establish the aesthetic system of oriental culture".

△ Traditional Chinese Opera+Blue Eye Special Effects

The special effects part of the film was jointly completed by the top special effects teams in Australia, New Zealand and Shenzhen, China. More than 600 split-lens pictures showed the freehand and restrained Song Dynasty painting texture to the fullest, giving the audience an ancient and fantastic experience. The eyes are full of landscapes, and different landscapes are unsympathetic. It is a unique image of Chinese classical scenery to anticipate things before seeing them. In this way, the mutual unity and set-off between the painting scene and the traditional Chinese opera performance is achieved, which is refreshing and will not cause a sense of deviation because the scene is too real and the performance is too artistic.

△ Design manuscript: Jinshan Temple

You can make a sword out of a fist.

Cantonese opera is one of the few traditional operas with practical martial arts, including Shaolin martial arts. In the movie, there are traditional Chinese opera martial arts movements such as the kite turning over, which are beautiful and enjoyable, and they are edited by means of quickly switching shots to make the play more fierce and full of strength. This is an innovative shooting method of traditional Chinese opera martial arts, which breaks the inherent impression that traditional Chinese opera martial arts are just "strokes". At the same time, the high-effect lens such as water flooding and golden hill also makes the dance sleeves appear more tense. Using modern technology to turn the audience’s imagination of the opera scene into reality is a "complement" to the blank part of the opera.

△ Traditional operas can also hang Weiya.

When the Buddha blooms, can we meet again?

White Snake gained an overwhelming reputation for his "hard core", but when he really appeared, it was very miserable. Under the unfavorable situation that only about 1% of films are arranged every day, it took nearly ten days to leave 6.7 million box office, even less than a fraction of the hundreds of millions of box office released in Fast & Furious 9 on the first day of the same period, which is the embarrassing situation that traditional cultural works are most afraid to encounter-applauding is not a box office.

However, it seems that this is not the case. Although the low film arrangement rate almost brought down this dark horse, compared with the decline in word-of-mouth and lack of stamina shown by films in the same period, White Snake’s word-of-mouth effect has begun to appear, and the box office has risen against the trend. Cat’s Eye has continuously raised its total box office forecast from one million to ten million. Although the box office growth is weak, it is enough to show the growth of word-of-mouth and market.

White Snake has its success, but due to many factors, it is still a long way from the big bang. It is biased to evaluate this film only by the current number of audience reputation and box office total. Even if the number of films is increased, it does not necessarily mean that the audience can be expanded. There is still a long way to go in the film production of Chinese traditional operas. In any case, White Snake is a bold attempt, showing the possibility of cross-platform communication and new production of traditional operas.

Behind White Snake,

It is a difficult road for Chinese traditional opera movies.

Although today’s traditional Chinese opera films have gradually faded out of public view, they once occupied a decisive position in the history of China films, and even witnessed the early film history of China. China’s first film "Dingjun Mountain" is a traditional opera film, and the traditional opera film "Life and Death Hate" directed by Fei Mu and starring Mei Lanfang is the first color film in China. The fifties and sixties were the most prosperous times of traditional Chinese opera films, with the output and quality reaching the peak. On the one hand, at that time, the audience had a high degree of acceptance of opera. On the other hand, opera films, as a political propaganda channel of the country, carried the social mission of enlightening people’s cognition, so they received strong support from the country. Directors of various studios represented by Cui Xie and Cenfan devoted themselves to the creation of opera films, and opera films showed a trend of blooming.

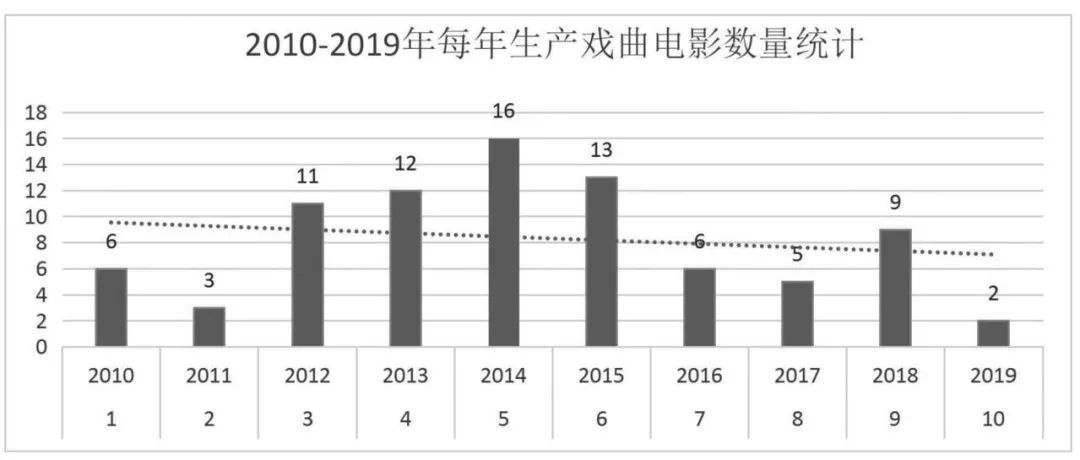

Since the 1990s, with the decline of traditional Chinese opera and the trend of film marketization, traditional Chinese opera films have gradually faded out of public view. However, in the past ten years, with the support of the state, the output of opera films has rebounded. In 2013, the state launched the "Beijing Opera Classic Traditional Drama Film Project". In July 2015, the General Office of the State Council issued "Several Policies on Supporting the Inheritance and Development of Traditional Chinese Opera" to further strengthen policy support and raise the support for traditional Chinese opera culture to the level of cultural strategy. In the second half of 2015, Shanghai launched the "Shanghai Opera 3D Film Project". In 2016, some major opera provinces also included the filming of opera films in their development plans. Under such a policy background, a number of 3D Peking Opera films, represented by Junjie Teng’s works, came into being.

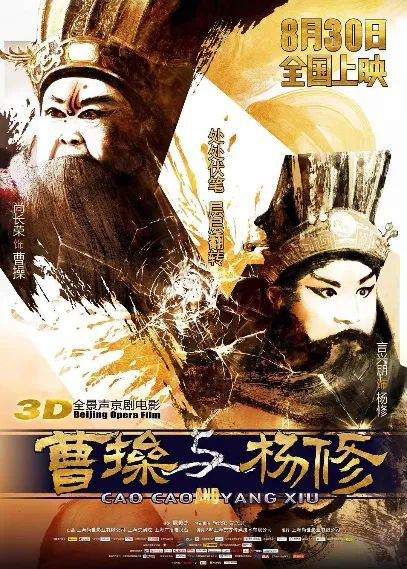

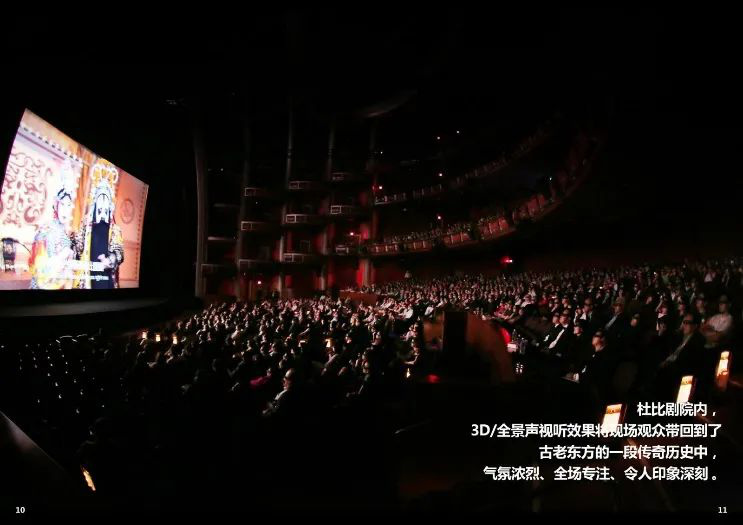

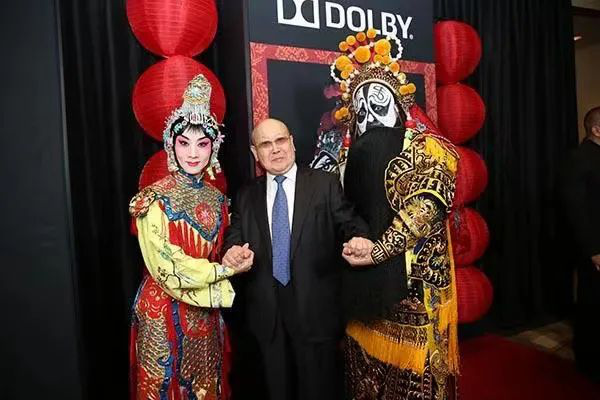

In 2014, Farewell My Concubine, directed by Junjie Teng, was the first Peking Opera film in China to be filmed in full 3D and adopted Dolby panoramic sound technology, which became the first China film premiered at Dolby Theater in the United States, and won the "Golden Lumiere-Best 3D Music Feature Film of the Year" award for the first time in China. 3D Peking Opera movies are widely recognized in the world, which can be said to be a cultural business card of our country in the world.

Although widely praised internationally, these 3D Peking Opera films are lacking in market performance. Throughout recent years, there are only a handful of traditional Chinese operas and movies with box office exceeding one million. The reason is precisely because these films completely retain the paradigm of traditional Chinese opera and lack entertainment, which naturally leads to the loss of most audiences. White Snake, on the other hand, didn’t take this old road. It targeted at young audiences who didn’t know about traditional Chinese opera through typology, thus greatly expanding the audience. White Snake is the first commercial attempt of traditional Chinese opera films in recent years, and its significance is groundbreaking whether it is successful or not.

White Snake: The new move is quite controversial.

For White Snake’s bold adaptation, although most of the audience have a positive attitude towards the special effects and pictures, there is also a critical voice of "Studio Aesthetics" in the comments. In fact, White Snake’s bold adaptation has angered a small number of audiences, especially Cantonese opera fans who love opera deeply. They think that the adaptation of the film has greatly hurt the essence of the drama.

The deep logic of traditional Chinese opera is hypothetical, and it is in the simple scenery with one table and two chairs that rich stylized movements have evolved. In traditional Chinese opera, the standing program, the walking program, the riding program, the riding program and the riding program, and the feelings of the characters such as joy, anger, worry, thinking, sadness, fear and surprise are all refined into a complete set of programs. And these are the essence of traditional Chinese opera. However, in White Snake, a large number of figures were drastically cut off, especially in martial arts. For example, in the scene of saving her husband in lady white snake, the stylized performances of "water sleeves" and "kicking guns" in the original Cantonese opera show the confrontation between lady white snake and the monks, which is one of the most kung fu-eating and wonderful scenes in the whole drama. However, in the movie, the sleeves were partially preserved, and the kicking gun was completely deleted.

As a drama film, White Snake abandoned a lot of the essence of traditional drama, so it is no wonder that fans regard it as a betrayal of traditional drama. The so-called charm of traditional Chinese opera, which is talked about by laymen, is actually an ancient style or a pan-China aesthetic experience. And this is an important strategy used by movies to attract young audiences.

The "antiquity" of ancient style is the "antiquity" constructed in the modern context, and the discourse system behind ancient style is modernity. Taking architecture as an example, the courtyard of lady white snake and Xu Xian’s residence is covered with white stones, and the vegetation scattered in it presents an irregular shape, showing a strong sense of modernity behind the antique.

For another example, the dense fog, bamboo forest, lotus flower, etc., which are frequent and even stacked in the film, are classic ancient images, and the appearance of these images covers most scenes. After deleting the complex figure and euphemistic singing that made the audience sleepy, the ancient image took turns to meet the audience’s aesthetic experience in a simple and rude way, so it was inevitably dismissed as "studio style".

White Snake’s aesthetic style of getting rid of the essence of traditional Chinese opera and creating ancient style is two-sided. In the eyes of experts, this is a betrayal of taking its dross and removing its essence. But it is undeniable that this strategy has played a decisive role in the box office. By deleting the complex figure, the entertainment of the film is greatly improved, and the rhythm is close to the fast-paced viewing habits of young people; By creating an antique style, the film is accurately positioned in the youth group with antique aesthetic preferences, which is undoubtedly much larger than the group of opera fans. With the "resurgence of domestic products" represented by the Forbidden City Handmade Office, as well as cultural trends such as Hanfu, ancient style has become a youth subculture. By actively moving closer to the ancient aesthetic paradigm, the director has offended some opera fans, but after all, he has won a larger audience.

summary

This situation of laymen praising each other and experts cursing repeatedly reflects the embarrassing situation of traditional Chinese opera films in today’s times. Today, with the gradual establishment of the film industry system, as an expensive industrial product, the commercial attribute of film can not be ignored. However, the real opera fans are too small to support the industrialized production of traditional Chinese opera films. Therefore, it is the only way to expand the audience and meet the aesthetic needs of the layman of traditional Chinese opera. Although White Snake’s artistic exploration shows the disadvantages of giving up the basics, it makes sense to put it in the industrial dimension. Although it is not perfect, the idea of expanding the audience through ancient elements can provide reference for the creation of traditional Chinese opera films in the future.

References:

[1] Gong Yan, Guo Xiaoqing. Overview of traditional Chinese opera films since 2010 [J]. New films, 2020(04):132-136.

[1] Class into a cloud. Thinking about the development dilemma and outlet of traditional Chinese opera films under the background of industrialization [J]. New films, 2016(06):84-87.