Explosive demand attracts the influx of capital. What new opportunities are there in the beauty industry?

From 2021 to now, the beauty track has been constantly running with "capital", which has surpassed last year in quantity.

According to public reports, on July 6th, the beauty industry was born with the largest amount of financing this year-KK Group was led by JD.COM with an investment of about 300 million US dollars. The group owns a large beauty collection store brand THE COLORIST and X11 and other new consumer and retail brands.

This is just a microcosm of the beauty industry. This year, there are only about 20 enterprises that have received more than RMB 100 million in financing, including Meishang, Lan, Xuelingfei, WOW COLOUR, USHOPAL and Liran.

With the help of capital, a large number of companies in the beauty field have gone public, covering the A-share, Hong Kong-share and US-share markets. Recently, companies that have been listed or will be listed in the beauty field include Kaichun Industry, Baiyang Medicine, Juju Zhilian, Betaine, Youquhui, and Yijia.

In this fiery market environment, the whole industry chain of beauty industry is welcoming the best times and the most business opportunities, and practitioners in the beauty field will undoubtedly enjoy more dividends. But if you want to capture business opportunities, you need to have a quick insight into the beauty industry.

Then, in the next half year of 2021, what are the trends and phenomena in the field of beauty that deserve special attention?

The heat of new consumption investment and financing has risen.The domestic product leader rises rapidly.

The glory of domestic products may be traced back to the perfect diary that sprang up three years ago. Many people once thought that this was just a gust of wind. However, a large number of brands, such as Huaxi Zi, Ximuyuan and Runbaiyan, which ran out in the following years, made people realize that the spring of domestic brands has really come.

Take this year’s Tmall 618 as an example. In the sub-category of beauty field, the performance of new domestic brands is particularly bright-in the four sub-categories of powder cake, makeup set, honey powder/loose powder, eyebrow pencil/eyebrow powder/eyebrow cream, Hua Xizi is the first; In the categories of makeup remover, pure dew, makeup spray, etc., it is the domestic brands such as one by one, the sky of daisies and Berry Beauty.

A data of Tmall can also prove this point. In 2020, 3,000 beauty merchants opened stores in Tmall, but more than 2,000 of them were new domestic brands. And among them, 30 beauty brands have become "dark horses", achieving sales of over 100 million.

Among them, there are a lot of investment opportunities, but capital is also a double-edged sword. How to treat capital rationally and grasp the investment opportunities is a subject we need to study. It is reported that the founding partner and chairman of Jiayu Fund will present the latest insight "Let capital empower brands instead of killing them" at the upcoming China Cosmetics Conference, and look forward to his opinions.

Cosmetic industry“The first share"Frequent listed companies have strong stock prices.

As of July 9, the closing price of Huaxi Bio (688363.SH), the first share of hyaluronic acid, was 284.30 yuan/share, which was more than five times higher than the listing issue price of 47.79 yuan/share. The P/E ratio has exceeded 200, and the market value once exceeded 150 billion. Huaxi Bio, which has the hard power of biotechnology and the whole industrial chain, has become the core asset sought after by investment institutions.

Since the renewal of management in the second quarter of 2020, shanghai jahwa, under the leadership of Pan Qiusheng, chairman and CEO, has started a century-old national brand revival war, with remarkable reform results, the stock price reached a record high, and the total market value once exceeded 40 billion yuan.

Polaiya, a local cosmetics company, has achieved rapid growth even under the influence of last year’s epidemic. This year, it has made a good start, with revenue of 905 million in the first quarter, up 48.88% year-on-year.

There are also companies such as Liren Lizhuang, Northbell, Yuyuan, Focus Media, etc., which are outstanding in the cosmetics track. It is reported that the chairmen or CEOs of these seven listed companies will gather at the 14th China Cosmetics Conference held at the Shanghai National Convention and Exhibition Center on August 5-6, when the latest strategies and the methodology behind them will be released on the spot.

Efficacy, skin care, high light moment, emerging track is worthy of attention.

This year’s 618, the only domestic brand in the TOP10 category of Tmall beauty is Winona. The data shows that Winona has been ranked as the TOP10 beauty and skin care category of double 11 Tmall for three consecutive years since 2018. Especially last year, Winona sparked a discussion boom with the only domestic brand of TOP10 in Tmall skin care category.

On March 25th this year, Winona’s parent company Betani successfully landed on the Growth Enterprise Market of Shenzhen Stock Exchange, with a total market value of over 110 billion yuan. Since 2017, Winona’s market share has gradually surpassed international brands such as Vichy, la roche-posay and Avene. At present, Winona ranks first in the domestic efficacy skin care market with a market share of 23%.

Winona is not the only one who has grabbed the huge dividend in the efficacy skin care market.

According to public information, in 2020, Tmall’s flagship store sales ranked the top three brands in terms of year-on-year growth rate, including Quadi and Runbaiyan under Huaxi Bio, and Yuze under shanghai jahwa. Among them, Quadi’s growth rate reached 99.94%, Runbaiyan’s growth rate reached 187%, and Yuze’s growth rate reached 265%.

Efficacy skin care market has become the hottest "emerging market".

Opportunity lies in China Cosmetics Conference.

In the field of beauty, if there is a platform that can link the most beauty resources and business opportunities, it is China Cosmetics Conference.

Since its inception in 2008, the China Cosmetics Conference, jointly created by Pinguan APP and Cosmetics Watch, has successfully invited at least 500 first-line coffee makers from the commercial, economic and even cultural fields in China to share their thoughts and opinions, including many bosses of listed companies outside the industry, top investors and opinion leaders, such as Zhong Shanshan, Shen Nanpeng, Jiang Nanchun, Wei Zhe, Luo Zhenyu and Fang Yuyou.

More than 200 investors from all over the country attend the meeting every year, which is an important platform for investment institutions and financial media to study the frontier ideas of market development and expand industry resources.

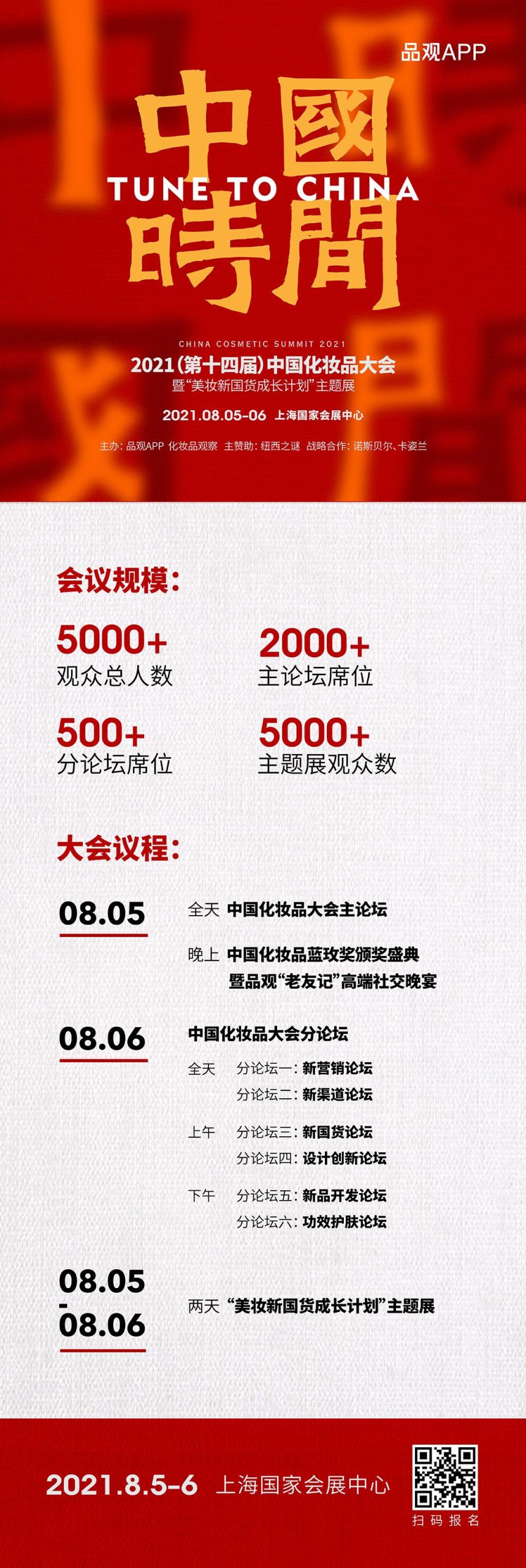

With the rapid recovery and prosperity of China’s beauty market ahead of the world, the 14th China Cosmetics Conference with the theme of "China Time" will be held at the Shanghai National Convention and Exhibition Center on August 5 -6, 2021.

In addition to the main forum, there are six sub-forums on new marketing, new channels, new domestic products, new product development, efficacy skin care and design innovation. The first theme exhibition of "Beauty New Domestic Products" will also be launched, and 100+ emerging domestic brands will be exhibited at the same time.

If you are interested in listed companies, cutting-edge domestic products and new beauty tracks, the 2021 China Cosmetics Conference is the most information-intensive and must not be missed event in the whole year. Scan the QR code below to view the full agenda.