Please note that these new regulations will affect your life and mine in August.

Xinhua News Agency, Beijing, July 30 th: Please note that these new regulations were "hot online" in August.

Xinhua News Agency reporter Bai Yang

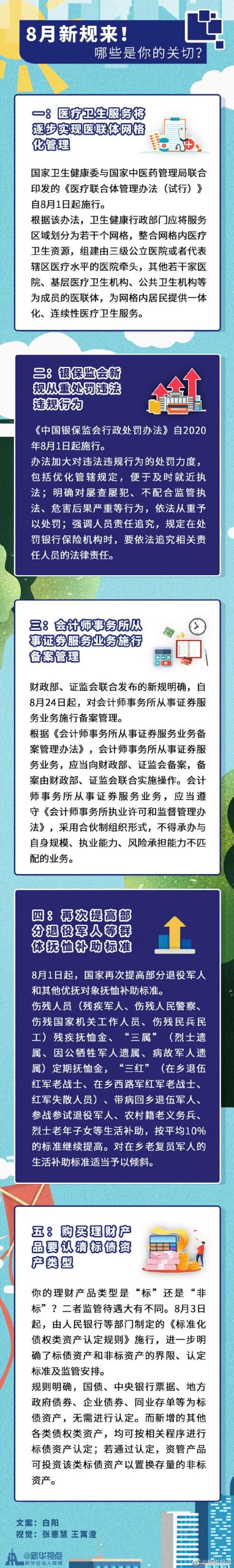

Residents will gradually realize the grid service of medical associations, the new regulations in China Banking and Insurance Regulatory Commission will further increase the cost of financial violations, and the pension subsidy standards for some retired soldiers and other special care recipients will be raised again … … This August, another batch of new regulations came into effect, affecting your life and mine.

Medical and health services will gradually realize grid management of medical associations.

The "Measures for the Administration of Medical Consortium (Trial)" jointly issued by the National Health and Wellness Commission and state administration of traditional chinese medicine came into force on August 1st.

According to this method, the health administrative departments at the city level and county level with districts make plans for the construction of medical associations in this region, and divide the service area into several grids according to geographical relations, population distribution, people’s demand for medical treatment, distribution of medical and health resources, and integrate the medical and health resources in the grids to form a medical association led by a third-level public hospital or a hospital representing the medical level in the jurisdiction, with several other hospitals, primary medical and health institutions and public health institutions as members. In principle, each grid is under the responsibility of a medical group or medical community to provide integrated and continuous medical and health services for residents in the grid.

The measures require that the construction of medical associations should adhere to the government’s leadership and effectively safeguard and guarantee the public welfare of basic medical and health undertakings; Adhere to the linkage reform of medical care, medical insurance and medicine, and guide the medical association to establish and improve the mechanism of division of labor and cooperation and benefit sharing; Guide the sinking of high-quality medical resources, promote the combination of disease prevention, treatment and management, and gradually realize the homogeneous management of medical quality.

China Banking and Insurance Regulatory Commission’s new regulations severely punish financial violations.

In order to standardize the administrative punishment procedures of banking and insurance industry after institutional reform, raise the cost of financial violations, and seriously rectify the chaos in the financial market, the Measures for Administrative Punishment in China Banking and Insurance Regulatory Commission, China came into force on August 1, 2020.

The measures integrated and optimized the procedures of administrative punishment in banking and insurance, established the basic principles of administrative punishment, such as legal procedures and fair penalty, stipulated that China Banking and Insurance Regulatory Commission and its dispatched offices set up administrative punishment committees, and clarified the respective responsibilities of the investigation department and the case trial department.

The measures focus on promoting the enforcement of punishment, such as optimizing the jurisdiction provisions to facilitate timely and nearby law enforcement; It is clear that repeated investigations and repeated crimes, failure to cooperate with supervision and law enforcement, and serious consequences will be severely punished according to law; Emphasis is placed on the accountability of personnel, and it is stipulated that when punishing bank insurance institutions, the legal responsibilities of relevant responsible personnel should be investigated according to law.

We will once again raise the standard of pensions and subsidies for some ex-servicemen and other entitled groups.

Since August 1st, the state has once again raised the standard of pensions and subsidies for some ex-servicemen and other special care recipients.

According to the notice of the Ministry of Veterans Affairs and the Ministry of Finance, the disabled persons (disabled soldiers, disabled people’s police, disabled state functionaries and disabled militia migrant workers), the "three families" (survivors of martyrs, soldiers who died in the line of duty, and survivors of deceased soldiers) receive regular pensions, and the "three reds" (veterans of the Red Army who retired in the countryside, veterans of the Red Army who went west in the countryside, and the Red Army who lost their lives), veterans who returned home sick, and participated in the war. Among them, the living allowance standard for old demobilized soldiers in rural areas is appropriately tilted.

Wealth management products should recognize the types of underlying debt assets

Is your wealth management product type "standard" or "non-standard"? The regulatory rules are very different. On August 3rd, the Standardized Rules for the Identification of Creditor’s Rights Assets formulated by the People’s Bank of China and other departments came into effect, which clarified the boundaries, identification standards and supervision arrangements of standard debt assets and non-standard assets, which will be beneficial to the standardized development of asset management industry and financial market and risk prevention.

The Rules for the Identification of Standardized Creditor’s Rights Assets is an important supporting rule for the new regulations on asset management. According to the identification rules, government bonds, central bank bills, local government bonds, corporate bonds, interbank deposit certificates, etc. are clearly the underlying debt assets and need not be identified. Other new types of creditor’s rights assets can be identified according to relevant procedures; If approved, asset management products can invest in such standard debt assets to replace the existing non-standard assets.