Zhejiang Securities Regulatory Bureau’s 2015 Annual Report on Supervision Information Disclosure

2015In, in accordance with the unified arrangements and requirements of the CSRC, our bureau conscientiously implemented the Regulations of People’s Republic of China (PRC) Municipality on the Openness of Government Information (hereinafter referred to as the Regulations), the Measures of China Securities Regulatory Commission on the Openness of Securities and Futures Supervision and Management Information (for Trial Implementation), and the Guidelines of China Securities Regulatory Commission on the Openness of Regulatory Information upon Application (for Trial Implementation), and earnestly promoted the disclosure of regulatory information in order to facilitate investors and regulatory objects to consult and accept social supervision.

I. Active disclosure of information

2015In, our bureau publicized government information through websites and other forms.344Article, mainly covering the following aspects:

(1) Important regulatory work trends

Publish important regulatory news in the column of "Regulatory Work"twelveArticle, mainly including the spirit of important meetings of the Central Committee and the CSRC, the development trends of the capital market in the jurisdiction, important work meetings in the jurisdiction, investor protection publicity, cooperative supervision and the progress of key work of our bureau.

(2) Announcement of important notices

Publish important notices and announcements in the "Notice Announcement" column.nineArticle, mainly including the abolition of some normative documents, the improved daily supervision workflow, the special inspection tasks assigned and the recruitment information of civil servants. Among them, our bureau has implemented the State Council’s decision-making arrangements on decentralization and transformation of government functions. On the basis of cleaning up normative documents in previous years,2015In 2000, we continued to clean up and abolish it.53Securities and futures regulatory normative documents and publicize them to further relax the control and restraint on the micro-level of market players.

(3) Work guidelines

In the "guide" column, the work guide for filing and approval matters is issued.sevenItem. Among them, our bureau compared with the CSRC2015Cancellation and adjustment of filing matters since, a total of cancellation of institutional futures filing matters were cleared.84Item, at the same time simplify the way of submission, cancel.31Written submission and36Requirements for submission of electronic message system. At present, our bureau reserves filing matters.103Item, there are regulatory documents and laws and regulations of the CSRC as the basis, and the cancellation rate is up to.44%.

(4) Administrative license

Increase the supervision of market entities on the operation of power through measures such as public approval of administrative licenses and timely publicity of work progress.2015In 2000, the approval of administrative license was issued and made public.45Pieces, only last year.20%, the release of administrative licensing matters acceptance and review progress publicity table.19Pieces. At the same time, greatly improve the efficiency of administrative licensing review. Taking the approval of securities fund management institutions as an example,2015Annual average audit of each administrative license11Days, the audit efficiency increased nearly compared with the previous year.thirty percent.

(five) administrative supervision measures and administrative penalties

Continue to increase the accountability of illegal market players and severely punish all kinds of illegal and untrustworthy behaviors. In the "integrity information" column, the administrative supervision measures involving listed companies, securities companies, commercial banks, etc. will be released in a centralized manner.11A, effectively improve the regulatory deterrent. In the "administrative punishment" column, the administrative punishment decision of our bureau was issued.fourPieces, the quantity is last year.fourTimes, increased the intensity of punishment and accountability.

(6) Information of listed counseling enterprises

Publish the basic information of counseling enterprises in the column of "Counseling Enterprise Information"66Article, counseling work progress report73Article, counseling work summary report50Article. We will provide convenient, low-cost and high-transparency services for market participants by improving the publicity and update frequency of market-focused hotspots such as counseling enterprise information.

(7) Market statistics

Publish "Monthly Report of Market Statistics in Jurisdiction" in the column of "Statistical Information"twelvePeriod, "the area of counseling and supervision briefing"twelvePeriod.

(8) List of supervised objects

Publish the list of listed companies in the column of "regulated objects"oneList of enterprises in the period and new third boardthreeList of futures and securitiesfiveList of futures and futures2List of futures and funds2Period.

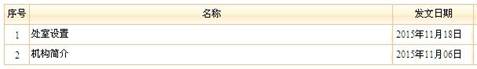

(9) Institutional functions

In accordance with the relevant requirements of the CSRC, carry out the adjustment of internal offices, improve relevant systems and processes, and clarify the positions and responsibilities of each office to better meet the needs of regulatory transformation. Update the profile of the organization and the setting of offices in the column of "Institutional Functions" in time.

Second, the publicity response

2015In 2006, our bureau publicized and conveyed regulatory policies and authoritative information through various means such as holding meetings and thematic publicity.

(a) the main person in charge of the speech

threemoon31sun, our bureau held.2015The main person in charge made a keynote speech at the regulatory work conference of securities and futures operating institutions in the jurisdiction in. The conference study conveyed the spirit of the national conference on securities and futures supervision, and reviewed and summarized.2014In this paper, the innovation, development and supervision of the industry in 2000 were analyzed, and the opportunities and challenges faced by the industry under the new normal were deeply analyzed.2015The work in 2000 was fully deployed, and media representatives from the jurisdiction attended the meeting.

sixmoon26sunOur bureau held the first regulatory meeting of private equity investment funds in the jurisdiction, and the main person in charge made a keynote speech. The meeting analyzed the development status of the private equity fund industry in the jurisdiction, conveyed relevant policies and regulations and self-discipline service measures, and put forward the next step to standardize the development requirements. Relevant departments of Zhejiang provincial government, responsible persons of local financial offices and jurisdictions have completed registration.500More than 100 private equity fund leaders and media representatives attended the meeting.

(2) Maintaining market stability

aim at2015yearsixThe stock market fluctuated abnormally after the end of June, and our bureau took a series of effective measures to ensure the stable operation of the market. The first is to guide the organization of Zhejiang listed company associations.184The listed companies in 20 jurisdictions issued a joint statement at the first time, promising not to reduce their holdings during the year, increase cash dividends and improve the transparency of information disclosure. The second is to supervise the listed companies in the jurisdiction to strictly implement the various notices of the CSRC on maintaining stock price stability.90%The above listed companies announced the stock price stability plan.

(3) Theme publicity

With "12.4The National Constitution Day and the National Legal Publicity Day took the opportunity to hold publicity activities for investor protection squares, closely following the themes of market risk disclosure, prevention of illegal securities activities, laws and regulations and integrity publicity. At the event site, through case risk warning and knowledge question and answer, the determination of "the regulatory authorities to safeguard the legitimate rights and interests of investors, especially small and medium investors, and promote the healthy development of the capital market" was conveyed to investors.

Actively implement the requirements of the CSRC on carrying out publicity and education on preventing illegal securities and futures activities into the community, cooperate with public security departments, and post posters on preventing illegal securities and futures activities into the community.sixTen thousand copies, distribution of brochures.sixTen thousand copies, covering all communities in the province (except Ningbo).

(4) Investor protection

Actively deepen the work of investor protection, and publish the market information of the jurisdiction in the column of "Investor Protection"oneArticles, illegal publications to publicize knowledgesixArticle. Among them, through the compilation of relevant cases and laws and regulations, the third batch was publicized.sixInstitutions without securities investment qualifications, summarizing and preventing illegal securities consulting activities, and other ways to strengthen publicity and guide investors to invest rationally.

(V) Media public opinion

In the "media reports" column, inform the press conference of the CSRC and forward the important work information of the CSRC.sixty-nineArticle. By revising the Measures of Zhejiang Securities Regulatory Bureau for News Publicity, the media reception and news release work will be standardized.

Iii. information disclosure upon application

(1) Application status

2015In, our bureau received a total of applications for government information disclosure.2Pieces. Among them, face-to-face applicationoneApplication for documents and lettersonePieces.

(2) the reply.

Our bureau is very concerned about the information received2All applications for government information disclosure were answered within the statutory time limit. Among them, those who agree to make a public replyoneA, agreed to part of the public reply.onePieces. Part of the application information has not been made public because it is not the government information referred to in the Regulations, does not belong to the information disclosed by this administrative organ, and the application information does not exist.

Four, regulatory information disclosure fees and exemptions.

2015In 2000, our bureau did not charge the applicants for information disclosure such as retrieval, copying and mailing.

V. Application for administrative reconsideration and administrative litigation due to information disclosure

2015In, there was no application for administrative reconsideration or administrative litigation for information disclosure in our bureau.

Six, the main problems existing in the supervision information disclosure and the next step.

2015In 2000, the supervision information disclosure work of our bureau achieved certain results, but there is still a gap with the growing demand of the public, and the relevant systems and working mechanisms of supervision information disclosure work need to be further improved. In particular, at present, there is a lack of specific operational guidelines for disclosure by application, and it is difficult to judge whether a small number of information disclosed by application belongs to the scope of disclosure, which is difficult to accurately grasp during review.

2016In, our bureau will further promote the disclosure of regulatory information from the following two aspects:

(a) increase the intensity of active information disclosure, standardize the disclosure of information according to the application.

One isIn accordance with the principle of "openness is the norm, and non-disclosure is the exception", we will increase the intensity of active information disclosure, improve the active information disclosure review mechanism and information disclosure guidelines in combination with confidentiality self-inspection, and enrich the information outside our bureau. Second, combined with the revision of the the State Council Municipal Government’s information disclosure regulations, we should formulate the rules for information disclosure according to the application, revise the information disclosure system, improve the circulation procedures and the case consultation and coordination mechanism, strengthen the internal coordination of information disclosure according to the application, and do a good job in legal review and confidentiality review before disclosure. The third is to strengthen the investigation and business training of information disclosure, strengthen the research and analysis of information disclosure cases in recent years, sum up relevant experience, and improve the supervision work of our bureau.

(B) to strengthen the interaction between information disclosure and public opinion guidance of news media.

One isBefore releasing important or sensitive work information, we should do a good job in guiding news propaganda, formulate emergency plans, and pay close attention to news public opinion after publication. Respond to problems and doubts with high social concern in a timely and accurate manner, release authoritative information, and strengthen public opinion guidance. Second, according to the Measures for the Press Work of the CSRC and the press work system of our bureau, we will further standardize the media reception and press release, strengthen the construction of information disclosure platforms and channels, give full play to the role of websites, press conferences, Weibo, WeChat, TV newspapers and other means to disseminate government information, and enhance the transparency of securities and futures market supervision.