The same search giant: Why is Baidu’s financial report more attractive than Google’s?

Today, Baidu released its financial report for the fourth quarter of 2019. In terms of core business progress, Baidu’s mobile business grew in an all-round way. The daily users of Baidu App reached 195 million, up 21% year-on-year, and the monthly active users of Baidu smart applet reached 316 million, up 114% year-on-year. Its positive potential further promoted Baidu’s net profit to 9.2 billion yuan in the fourth quarter, up 95% year-on-year.

Baidu’s commercial revenue has increased for three consecutive quarters, and it has continued to rebound. Its profitability is improving and it has gained more users.

Baidu mobile ecology entered the delivery period.

Behind Baidu’s sustained high growth, Baidu’s mobile ecology has taken shape, and it has now entered the delivery period and the income realization period.

At present, Baidu mobile ecology has formed three pillars: Baijiahao+smart applet+hosting page.

Looking back, we will find that Baidu’s mobile ecological layout has been constantly adjusted and upgraded in the past few years.

In the past few years, Baidu has been solving content problems by laying out hundreds of numbers; In 2016, Baidu launched an information flow product, established a dual-engine strategy of search+information flow in 2017, and released smart applets in 2018. In July 2018, after initially solving the content problem, Baidu began to build new connections. Last year, the dual ecological pattern of "No+smart applet" was gradually formed.

In December 2019, Baidu App had a daily activity of 195 million, Baijiahao had 2.6 million content producers, the release of original content was more than three times that of the same period last year, and the monthly active users of Baidu smart applet reached 316 million. The number of smart applets is 35 times that of a year ago. The initial scale of smart applets has enabled Baidu to form a closed loop from retrieving information to obtaining goods and services.

The benign interaction and content diversification ecology formed between search and Baijiahao and smart applets have gradually broken the "island" effect of the mobile Internet.

In the second half of last year, Baidu began to encourage advertisers to migrate landing pages to "hosted pages". Merchants can independently publish content, information and services to achieve efficient connection and interaction with users, reducing the risk of landing pages and improving advertising quality and user experience.

The financial report shows that in the fourth quarter, the revenue of hosted pages increased to about a quarter of Baidu’s core revenue. It is understood that the solution of hosting page has covered life service, B2B, law and other fields, and advertisers are also actively embracing Baidu hosting page.

An important reason is that those smaller businesses that do not have the development ability can use Baidu’s artificial intelligence capabilities through Baidu’s hosting marketing platform. Small and medium-sized enterprises can keep up with the latest internet technology and continuously improve the conversion rate by opening an account without buying servers and software. Moreover, the hosted page is built with a data structure, which can guarantee the quality of content and enhance the trust of consumers.

Behind the continuous high growth of Baidu App’s daily activities and user duration, the dual ecological construction of Baijiahao and smart applets has been initially completed, and the managed page mechanism has also achieved results. The three pillars have entered the delivery period from the construction period, which also gives Baidu the ability to help advertisers build a closed-loop marketing.

In fact, it also confirms Citigroup’s judgment in Q3 last year: the combination of Baijiahao+smart applet+hosting page has improved the user’s usage time and user experience; The number of in-terminal searches has increased, and it is expected that the traffic and in-terminal queries will be consistent with the income growth in the second half of 2020.

Baidu’s financial report is more attractive than Google’s.

As a search giant, Baidu is often used to benchmark Google, but at present, Baidu’s financial report is more attractive than Google’s.

Google’s previously released financial report data showed that its operating profit in the fourth quarter of 2019 was 9.3 billion US dollars, far below the market expectation of 9.9 billion US dollars. Alphabet’s revenue in the fourth quarter was $46.1 billion, less than analysts’ expectations of $46.9 billion. A number of indicators failed to meet Wall Street expectations, and the core revenue advertising business was also slightly tired. Analysts question how Google should support the trillion-dollar market value in the future.

One is lower than expected, and the other is stabilizing and warming up. Behind this is actually that the business growth space and potential brought by the ecological innovation of mobile content are different.

Behind Google’s lower-than-expected revenue is the lack of innovation highlights in the digital advertising business that supports its core revenue, the lack of achievements in the ecological layout of mobile content, and the failure to effectively upgrade its business performance and user experience, which suppresses its liquidity in digital advertising and the expectations of the capital market.

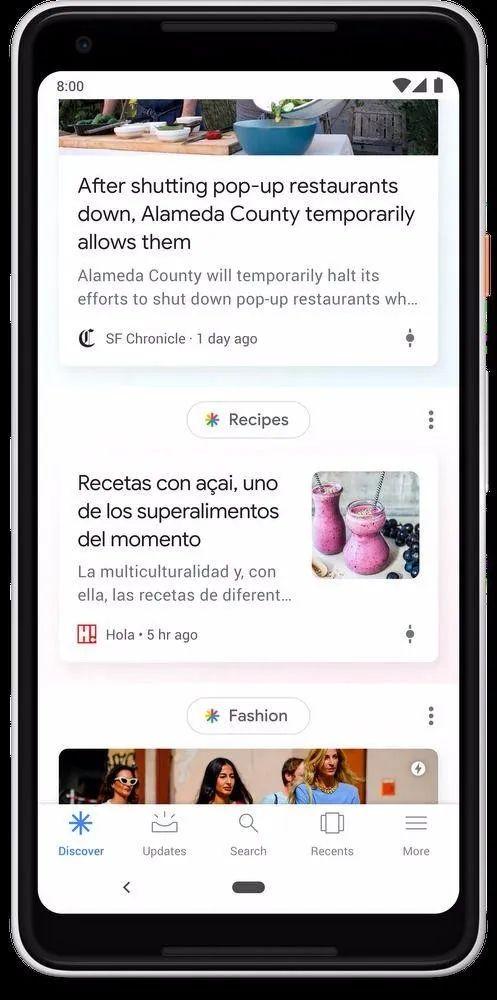

For example, it was only in September 2018 that Google announced that it would push the news of information flow through the "Discover" function, but its information flow business at this time was already two years later than Baidu’s. Nevertheless, Google only planned to invest in information flow advertisements on the home page of mobile applications in 2019, and now the effect is not obvious. Google’s core advertising model is still following the past "search" advertisements, including Google Adwords and display advertisements.

In addition, in response to the general trend of online shopping users bypassing Google search and directly searching for products through platforms such as Amazon and Wal-Mart, Google launched "popular products", which enhanced the search function of e-commerce, searched for keywords, and products appeared on the search results page with a sliding and interactive interface. However, Google’s single function, which is based on saving users and rushing online, lacks overall strategic thinking. At present, the effect remains to be seen, because the search experience of platforms such as Amazon has formed a strong appeal to shoppers.

According to eMarketer, Amazon is expected to report that its share of net digital advertising revenue in the United States will increase from 6.8% in 2018 to 8.8% in 2019. Facebook’s market share is expected to rise from 21.8% in 2018 to 22.1% in 2019. Google’s market share is expected to drop from 38.2% in 2018 to 37.2% in 2019.

Analysts are questioning whether services such as Amazon and Facebook’s Instagram are attracting online shoppers and thus attracting advertisers away from Google.

For many years, Google’s revenue has been highly dependent on advertising, but Google has not formed a set of mobile content ecology that is constantly upgrading, serving both brand commercialization and users’ rigid needs to promote the continuous improvement of its content and experience and provide incremental value to advertisers. Therefore, in the face of Facebook’s social advertising and Amazon’s e-commerce advertising, the competitiveness of Google’s old advertising model’s user experience and effect is weakened, and its advertising market is also being eroded.

However, the incremental space of Google’s original mobile mode is quite limited, so its growth is increasingly dependent on YouTube and cloud services.

However, under the strong suppression of Amazon and Microsoft cloud business, it is difficult for Google Cloud to support its second growth curve. According to research institute Gartner, Amazon AWS currently ranks first, accounting for 32.3% of the market share in the cloud computing market; Ranked second is Microsoft Azure, with a market share of 16.9%; Google Cloud ranked third with 5.8%.

However, on Baidu’s side, the three pillars of Baijiahao, smart applet and hosted page promote Baidu’s business ecology, and Baidu Mobile Ecology can better achieve the double matching of content and service, thus better retaining users and developers. And brand owners, achieving a balance between business and user experience.

In addition, Baidu carried out a comprehensive "upgrade" of information and knowledge in 2019–not only self-built content, but also strengthened the knowledge and information ecology through strategic investment.

In the past 15 years, Baidu has accumulated more than 1 billion pieces of high-quality content including knowledge, encyclopedia and library. Baidu Encyclopedia, Baidu Library and Baidu know that these three products have established cooperation with more than 7,000 authoritative organizations such as China Association for Science and Technology, China Anti-Cancer Association, People’s Daily Digital Communication, and National Literature Center for Philosophy and Social Sciences, so as to promote more authoritative and professional knowledge content and structure.

Baidu’s own content system-Post Bar, Know, Encyclopedia, Baijiahao, Iqiyi, Good-looking Video and other content and information channels have been fully connected and searched, completing the closed loop of mobile ecology.

At the same time, Baidu has successively invested in high-quality vertical content such as fruit shell, uncle Kai telling stories, Zhihu, etc., and entered the children’s content track, free reading entrance and knowledge quiz community respectively. These contents are connected to Baidu App and integrated into the product matrix such as information flow.

Take Zhihu as an example, it has 220 million users and 130 million answers, and a lot of content can already be seen on the homepage of Baidu search.

This mobile ecology with information and knowledge as the core has two values:

On the one hand, it can reflect the development trend of events through the summary, integration and analysis of information, and deepen the understanding and understanding of things. Based on a powerful knowledge map, it can help users greatly expand the boundaries of knowledge. For example, in this epidemic, the value of big data formed by "knowledge and information ecology" highlights its important decision-making value in epidemic prevention and control.

On the other hand, implement key influence on users’ key decisions. Obtaining information is a key node in the user’s decision-making path. Baidu can implement key influence on both search and recommendation decision paths, and Baidu has entered the stage of mining users’ commercial value from the pursuit of traffic.

That is to say, its entire ecosystem has formed a closed-loop and synergistic effect. Through search+information flow, it comprehensively covers the users who need search and the user groups who obtain information, and takes the "ecology with information and knowledge as the core" to intervene in every step of the user decision-making chain, accurately understanding the user’s needs. The ecological barrier of mobile content in turn improves the efficiency of advertising realization and strengthens the search moat.

However, we pull the perspective back to Google. At present, Google has not made similar innovations and layouts in the mobile content ecology, but has been adding more and more advertisements to existing search platforms and map products. Despite the overall slowdown in growth, the ninth operating profit in the past 10 quarters failed to meet expectations, Google still follows its inherent search advertising model.

This is why Baidu is more attractive than Google’s financial report, because the two have been on different tracks. Relatively speaking, Baidu has been deeply involved in the mobile content ecology in recent years, and when it is busy, Google continues to be in an old-fashioned mentality in the mobile ecological layout. Although Google is still making money, as Facebook and Amazon continue to nibble at the plates of digital advertisements, there is not much time left for Google’s layout.

Behind the high growth, the potential and value of Baidu’s business ecology

In the context of the overall pressure on the advertising industry in 2019, Baidu’s business grew steadily for three consecutive quarters. The author believes that Baidu’s mobile content eco-driven marketing model upgrade has broken through the ceiling of the advertising industry.

This is reflected in the layout of the content layer "Baijiahao+smart applet" and the touch layer "search+information flow", which can not only provide one-stop service for users, but also provide advertisers with a complete ecosystem of integrated delivery. On the one hand, Baidu’s strategy of exchanging investment for growth is quite effective, and it also stems from the steady rise of the content layout that blooms in all directions and enters the harvest season.

Especially when we compare Tencent and Baidu, which are also engaged in information flow business, this experience of content ecology is very valuable.

First, Baidu advertising puts more emphasis on user safety, which improves the advertising quality and user experience. Tencent has display advertisements, mainly Tencent News and Tencent Video. There are online alliance advertisements such as Guangdiantong, social advertisements, etc., which relatively retain the traditional advertising model and experience.

The upgrade of Baidu’s advertising model lies in that "hosted pages" greatly reduce the risk of landing pages, while the ever-developing content ecology and services attract creators and providers to put content and services on Baidu’s hosting platform, which attracts more users on the one hand and improves the advertising quality, user experience and advertising conversion rate on the other.

The second is the difference between information flow advertisements: both of them have information flow advertisements. Baidu takes Baidu App as the core, and integrates the channel traffic and content service resources within the system, providing an internal driving force for the accurate matching of user duration and advertisements. Although Tencent’s information flow business integrated QQ Watch, QQ Browser and Daily Express last year, the product lines such as Tencent News, Daily Express and Microvision are still independent.

With a high-quality product team and traffic, Tencent’s advertising business is dull or there is no closed loop in the content ecology.

Third, Baidu’s advertising revenue growth against the trend depends on its content ecology and the mature ability of the whole chain marketing model.

An important action of Baidu on the commercial side in 2019 is the launch of "N.E.X.T Baidu Full Chain AI Marketing". What it is doing is to form a full-chain user interactive marketing scheme through the combination of public domain, commercial domain and private domain traffic-from search to generating consumption intention to final consumption action, the whole link can be completed within Baidu’s ecology. Baidu AI and big data help brands to find potential users, and then rely on Baidu’s ecology.

In addition, Baidu has strengthened its IP capability. Last year, Baidu announced eight IP resources, including Baidu, Baidu National Tide Season and Good Luck China Year. Relying on the resources such as video, content and offline activities in Baidu’s ecology, from last year’s National Tide Season to Baidu’s boiling point, it can be seen that the integration and linkage of these resources and portals shortened the link between brand exposure and transformation.

For advertisers, Baidu’s AI+IP is showing new potential-various IP resources are driven by AI, forming a more diversified gameplay upgrade, and the traffic value after IP packaging has also been further developed, that is, Baidu’s content ecological layout has driven the industry marketing to break, highlighting new commercial potential.

Conclusion:

If we review Baidu’s continuous content ecological layout for many years, we can know that Baidu has been delaying its satisfaction, putting its goal in a few years and paying more attention to long-term value.

Baidu’s new financial report has gradually highlighted its upward trend, which actually means that after half a year’s adjustment, Baidu’s mobile ecology has entered a stable growth channel and entered a delivery period and a revenue period. Its layout in the mobile content ecology is also fully stimulating its users’ commercial value. Judging from its performance, Baidu’s good days may have just begun.

Author: Wang Xinxi TMT Senior Commentator This article refuses to reprint my WeChat WeChat official account: Hot Micro-comment (redianweiping) without permission.